Despite the huge success that mobile money has been enjoying, some of its iconic services don’t seem to get noticed. Case in point, EcoCash Save. Considering our challenges with financial inclusion, this was a great concept. But other than the EcoCash Credit we haven’t heard much noise or product iteration around it, until now.

Despite the huge success that mobile money has been enjoying, some of its iconic services don’t seem to get noticed. Case in point, EcoCash Save. Considering our challenges with financial inclusion, this was a great concept. But other than the EcoCash Credit we haven’t heard much noise or product iteration around it, until now.

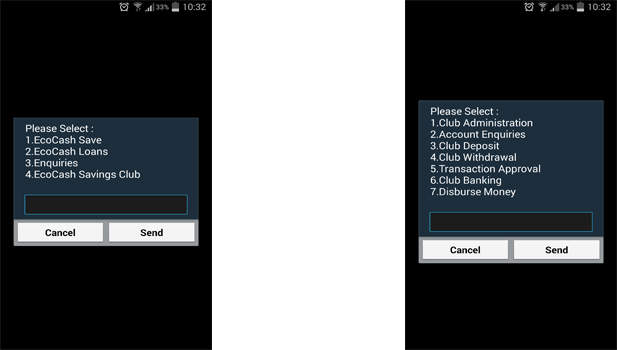

Yesterday Econet launched a new product called EcoCash Savings Club. This is meant to support savings groups that most of us know as maround or mukando. The mobile product allows anyone registered on EcoCash to create a group wallet where fellow participants or members of the savings club contribute funds just as they would in an “offline” arrangement.

Each member of the club can check the group’s account activity at any time on his or her phone and It’s free to move funds between the group wallet, individual wallet, and bank account. The service is already active on the EcoCash menu (under EcoCash Save)

The product was a result of joint efforts with the Organisation For Public Health Interventions (OPHID) – a Non-Governmental Organisation that has been working with women throughout the country. EcoCash Savings Club was actually launched in rural Marondera, at a clinic where the product has been in pilot phase for 6 months.

The product was a result of joint efforts with the Organisation For Public Health Interventions (OPHID) – a Non-Governmental Organisation that has been working with women throughout the country. EcoCash Savings Club was actually launched in rural Marondera, at a clinic where the product has been in pilot phase for 6 months.

Econet has its eyes set on the huge number of people that have formed savings groups in both urban and rural areas. This communal approach to small-scale financing and saving is very common across Africa, which would explain why in countries like Uganda a similar service was launched by Airtel last year. Kenya has also seen similar efforts to digitalise and formalise savings groups with a startup called Chamasoft gaining recognition for its efforts in this arena. Mobile operator Safaricom Kenya also has the M-Pesa Chama Account.

There are plans to broaden the awareness of the service throughout the country and Econet intends to work with non-profit organisations to do this. The exciting bit in terms future plans is how this service will be extended to other EcoCash services that include a credit facility.

You can find Econet’s press release for this service by following the pdf link below.

Comments

10 responses

What percentage interest does the money earn per month, in the statement it just says,”Savings clubs earn interest on all

pooled funds starting from $1 after every 30 days.”

The interest will be so low that it wont be worth while just to keep the money there friend.

Anyone interested in starting an investment group?

me

Hesi mhani maakutambira maround pamafone. kkkkkkkkkkkk

This is one very relevant product from Econet after so many attempts of uselesses. You have definitely been operating on an “AIM 20 shoot 1” principle

Good report Nigel. I completely agree about the lack of noise on successes with EcoCash in Zimbabwe, nor much noise about successes with about two dozen other successful Mobile Money initiatives involving Carriers/MNOs … in Africa, parts of Asia, as well as in Central America, Oceania and elsewhere – spanning approximately 60 countries already. Groundwork efforts are underway to help address this lack-of-noise matter with the establishment of a entity committed to this space and helping champion advocacy along with companion awareness driving to help trumpet the successes and the significance of the value-add brought to the lives of so many. If you are interested in learning more, please contact me (here or via LinkedIn).

we have lost all respect for econet thats why we dont like their products anymore,there prefer to impoverish you to make money..so let them try and make money in a hostile market.we will see its all about legitimacy strive i struggled to get a license mantra is washed up these guys are just driven by greed.chokwadi econet inokusveta

Econet stole their latest idea …see below

‘Econet stole my idea’

Econet Wireless is likely to face a lawsuit after reportedly hijacking a mobile savings scheme targeting low-income women’s grassroots groups.

by Staff Reporter

Strive Masiyiwa, founder of Econet. His middle managers have been accused of hijacking a savings scheme. Strive Masiyiwa, founder of Econet. His middle managers have been accused of hijacking a savings scheme.

The company was recently embroiled in a media storm after it raided a local publication, The Source, accusing it of stealing documents for use in a story. The move was widely condemned by journalists and civil rights defenders.

The EcoCash Savings Club scheme was launched on May 6 and is anew mobile product supporting informal savings groups in Zimbabwe. The initiative is meant to benefit subscribers registered on EcoCash, the mobile money transfer platform, with informal savings clubs earning varying amounts of interest over a 30 day period, depending on the amount deposited.

Econet is partnering with the Organisation for Public Health Interventions (OPHID), a local NGO, working especially with women’s groups, but the scheme is generally aimed at millions of mostly low income subscribers – the self-employed, informal sector entrepreneurs, street vendors and social investor women’s groups.

Striking similarities

A non-profit savings outfit, Money Book Capital Trust (MBCT), is alleging that Econet stole its idea for the scheme through middle-rank managers with whom the concept had been shared.

Volumes of documents made available to The Zimbabwean show that MBCT shared its mobile savings idea with staff from Econet and Ernst and Young years before the mobile service provider launched the scheme.

There are striking similarities between the recently launched scheme and the concept that MBCT shared with staff from Ecobank—a subsidiary of Econet—and Ernst and Young.

The documents show that MBCT, right from the start, intended to use Econet facilities, among them the Ecocash mobile money transfer platform and Ecobank to roll out the savings initiative to a million low income beneficiaries by 2015.

The concept by MBCT also shows that it would target some 75 percent of women as its beneficiaries using the Econet network, as is the case with the recently launched scheme.

Side-lined

Sacha Robinson, one of the partners in MBCT, expressed shock that Ecocash had gone ahead and launched a scheme without consulting him or his partner, Paul Hopley. Robinson said he learnt of the development when he read a newspaper report.

“I hoped this day (of the launch) would arrive at a time when we would have achieved partnership with Econet with a view to expand my proposed concept globally but the (news) article… indicates that we have been sidelined and my idea that myself and Paul Hopley worked on diligently with E & Y and Ecobank and Econet has been encroached, compromised and indeed appropriated,” said Robinson.

“I remind you that we have an agreement with Ernst & Young, specifically for this project and in partnership with Econet,” he added in an emailed letter to Ernst and Young’s Chenjerai Maziwisa on May 9.

Moral fight

He indicated that even if fighting the Strive Masiyiwa empire, which owns Econet, might be an uphill task, it was still an option they were considering, and described the alleged theft of their concept as “selfish, dishonest and harmful practice”. But he absolved Masiyiwa of any wrongdoing, accusing middle managers of the hijack instead.

Robinson said he picked up signs of plans to steal the idea some two years ago when Econet released a press release on the planned scheme, and claimed that he had all the correspondence regarding the details of the deal.

He warned that the alleged dishonesty by Econet management would undermine the mobile operator. “I will be seeking legal advice on how to deal with this apparent leak and seeking for this matter to be righted either way … we will state upfront that this is not a financial fight but a moral fight for what is right,” he said.

Correspondence from Maziwisa to potential partners in the project, written in February 2013, suggests that there were collaborations in setting up the scheme.

Brian Jerahuni of Ecobank wrote also to Robinson on March 13, 2013, acknowledging knowledge of the proposed concept and its potential. He said the involvement of Ernst and Young as the fund managers gave credibility to the project.

“If confirmation that Ernest and Young are the fund managers then it’s worth our consideration. We will need to be sure of the reputational risk of non-delivery by the fund (sic),” wrote Jerahuni.

He asked Robinson if they expected to use the Ecobank licence for fund mobilisation and lending and acknowledged that daily savings reflected in the concept by MBCT was a new phenomenon in Zimbabwe, adding that it “mirrors the informal savings rounds in which most women and informal traders participate daily”.

The documents also show that Ernst and Young prepared a confidential information memorandum on behalf of MBCT that shaped the mobile savings concept.

need to open and have an ecocash saving club account

need to open and have an ecocash saving club acount