Even after the recent downward review of the bank charges, the truth is that RTGSs (and people looking to access their cash have to make a lot of them) at $3 a transaction, are still quite expensive to do. And ofcourse EcoCash still charges the sender up to $7 for a $100 transfer to an unregistered number and a recipient $3 to cash it out – $10 transaction fees in total (see tariffs here).

The sad thing is that there’s a way to avoid these heavy bank charges. The awareness of how is just very low.

I hope this article is going to be very clear about how. If it’s not clear enough, please help me out by pointing out what I can simplify further or even just how we can help increase the awareness. Here goes:

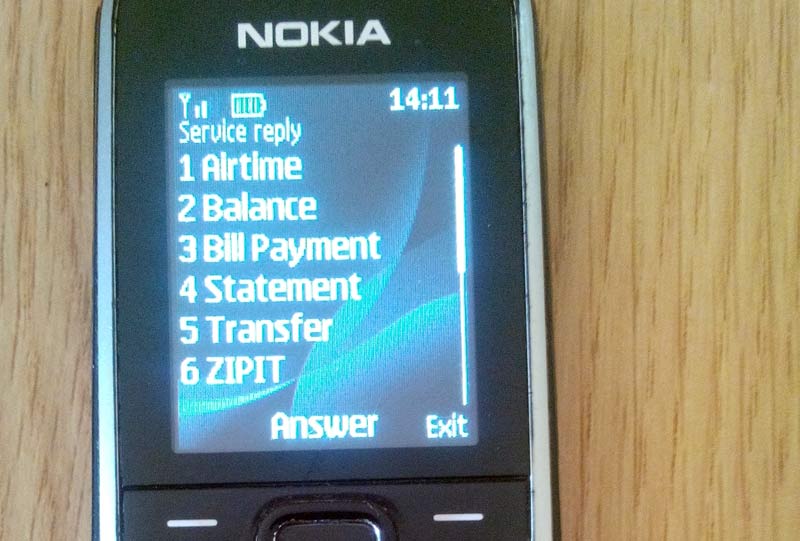

There’s mobile money service that almost all banks offer. It’s almost like EcoCash but it uses ZimSwitch’s ZIPIT technology.

What ZIPIT is and why it’s a big deal

- Almost every bank has a mobile money service (you can call it mobile banking) that you can access via your mobile phone’s USSD just like EcoCash and Telecash. It’s a big deal for 2 reasons:

- The first is that you can transfer as much as $10,000 to almost any bank account in Zimbabwe for just a flat fee of about $1

- The second reason is that all transfers go through instantly so no more waiting days for RTGSs to go through.

- You can use the service for other things as well like buying airtime and paying bills.

- Each bank has a different name/brand for it but it’s just the same ZIPIT service at the core.

For example, CABS calls it Textacash, FBC calls it Mobile Moola, at CBZ it’s CBZ Touch, at MetBank MetClick and so on. But essentially when you approach your bank, you want to ask them about their new phone USSD based banking. (don’t mention ZIPIT as some tellers will give you a blank stare – I had that experience at NMB.) - To start using the service you simply enable mobile banking on your existing bank account by signing up at your bank. Kind of the same same way enabled internet banking on your account.

- If, however, you happen to not have a bank account at all, then just pick a bank and sign up for a mobile banking account. It’s not hard to get like the traditional bank account – they won’t ask for your grandmother’s birth certificate. All you will need is your ID.

- Once your account is enabled for this service, you can use your bank’s USSD code to start transferring money from your phone.

Here’s the list of banks and their USSD codes.

| Bank | USSD Code | Send Money |

|---|---|---|

| Agribank | *277# | Yes |

| BancABC | *242# | Not yet |

| Barclays | *229# | Not yet |

| CABS | *227# | Yes |

| CBZ | *230# | Yes |

| Ecobank | *245# | Not yet |

| FBC | *220# | Yes |

| MBCA | *299# | Yes |

| Meikles Mycash | *212# | Yes |

| Metbank | *234# | Not yet |

| NMB | *240# | Yes |

| POSB (Econet) | *223# | Yes |

| POSB (NetOne & Telecel) | *222# | Yes |

| Stanchart | *200# | Not yet |

| Stanbic | *247# | Not yet |

| Steward Bank | *210# | Yes |

| ZB Bank | *400*600# | Yes |

Updated 11 December 2016. Added Steward Bank to the list.

- To send money, for example using the POSB service, dial *223# and select ZIPIT, then select bank, then amount…

Ofcourse once the money has been transferred to you, you need to avoid withdrawing the cash as this will only attract the ridiculous charges by the banks ($4 I was charged by NMB last week for withdrawing $70). Use plastic money instead to enjoy the RBZ review charges.

Why you didn’t know about this yet

I personally think it’s because, even though this is one service – a ZIPIT service – the banks have different brands front it and they explain the service differently. CBZ for example are pushing the app angle very strongly. We hear NMB are planning the same.

Maybe banks should present consumers with the same message. Or maybe Zimswitch needs to do the marketing on behalf of the banks underscoring how this is the same simple way to transfer money. Or maybe, one clever bank needs to own the message and have the market all flocking to them.

54 comments

You have overstated the EcoCash charges there check again.

see https://www.econet.co.zw/ecocash/tariffs-limits

Sending to unregistered number is $7 and cashing out is $3

Yes, sending $100 to a registered number is $1.98 but thought it would make more sense pointing out the maximum. I have updated the language to show it’s up to, and inserted a link to the EcoCash tariffs page.

There is zero charge cashout when you send money to an unregistered number using ecocash. Cash out fees are only for registered numbers. So the maximum transaction cost when sending $100 is $7 and not $10.

Correct. Made an error there. I have updated the article to reflect that fact. Thanks.

Usanyepere vanhu no cash out fee for unregistered subscriber

error. fixed. thanks.

No charges for unregstered subscribers on cashing out

error. fixed. thanks

Thanks for educating the Nation on how to save money in these trying times. No bank has really advertised the service despite some of us having known of the service since 2014. However you highlighted the list of all banks USSDs although i understand some banks are not on the ZIPIT platform – please correct me if i’m wrong! On Ecocash charges you seem to have overstated them although it’s high time the charges needs to be reduced. Ecocash remains the mostly widely used and still our most convenient service. A good article though.

From the knowledge we have, all the banks have those USSD codes assigned to them and those that don’t have the service active yet are in the process of doing so. Not sure though how long this will take.

I have a dormant account with Ecobank and really, until I can use USSD to transfer money from the account, I see no point in activating the account, so I’m looking forward to them activating this

The EcoCash charge mentioned is the maximum fee on $100. I have updated the language to indicate this.

https://www.econet.co.zw/ecocash/tariffs-limits

I think some of the services are/were not advertised because they were not “production” quality yet. The USSD banking services for NMB were implemented by eSolutions, which they so proudly stated when you activated it, but when I used it, I was so worried and scared by my experience. I had received my salary earlier on in the week (same week I activated mobile banking). When I did a balance enquiry just to check if all was well, it reported that I had about $6 in my account. I was shocked. In the morning I went to the bank to check what had happened. As it turned out, the account balances on the USSD platform tend to lag behind. Scary isn’t it!! Because you could easily transact on money you already spent/withdrew and find yourself with new problems and overdraft charges. Anyway, I got my accounts deactivated from the service that very same day!! Bad information results in bad decisions, so what use is a banking app that can’t tell how much I truly have…

I got charged about $5 to eco cash $270

If you were sending that money to a registered number, the correct tariff is actually $3.79. The recipient would be charged. Sending it to an unregistered number, e.g. your a Telecel or NetOne number would cost $11.

In the case of the registered recipient, cashing it out is $4.85

Your talk about Ecobank. Is that Steward Bank ?

No, my dormant account is with Ecobank. As far as I know, they don’t have the sending facility enabled yet.

No…. two separate banks… just to be complicated … eco bank and ecocash don’t seem to be related !

Previous articles i have seen have a ‘Sponsored’ badge on them. This one?

When it doesn’t have the sponsored tag, it means it’s not sponsored.

You’d actually be surprised to know that the Zimswitch team is not too happy (the marketing guy we spoke to at least) to have publishing this without their involvement.

We found this information very helpful when we encountered it, and that is why we share it.

Sounds sponsored too… Regardless what LSM is saying.

We used MyCash and when checking the balance on the account and a ministatement we found we were charged 15 cents just to look at the balance and 15 cents to get a ministatement to find out why we had a 15 cent charge!! They advertise no transfer fees, but don’t mention that they charge you just to look at your account – b it sneaky that?

yeah, very sneaky actually. We’ll try to confirm the fee structure and update article when we get it.

They are network charges..they pointed them out under the stared note(*)

It’s very silly too. Stanbic charges 10c for a balance enquiry and 10c a mini-statement. Where are they coming up with those costs from? I already pay a $5 service charge a month, isn’t that what it’s for, for services I get from the bank…

ZIPIT (or Zimswitch) are really in the PIT. I contacted them following your previous article about their service and they completely disowned marketing the service and said is each bank’s responsibility to go-to market. I tried to discuss with them the advantages of having all value chain members marketing such a service but they did not have seem to see any benefit in that. So good luck in your suggestion that they jump in. I think the last sentence in your article is more feasible than trying to drag ZIPIT out of the PIT!

Good article man thanx the bigger picture is you have provided us with an alternative which banks have failed to properly sell to us.

Glad you found it useful.

I see no Steward bank there

To the best of our knowledge, they don’t have this service yet. We will update the table once we hear they do.

Steward bank is now on the system. *210# You may want to update your table.

Had been using the online platform ye Ecobank for a while (after the Commerzabank Drama). ya USSD ikaita kaone. Else taingokandirana mari textacash to mobile moola and back – fast and easy.

Cbz its called cbz touch not smartcash, smartcash is the name of the mobile bank account wich only needs a copy id for sign up

interesting. thanks for the information.

It’s also not true to say to say that you can send to any bank account.This also contradicts with what you state in the article . I bank with cabs and I can’t transfer to Barclays for example…

Thanks for the information Chivheya. You’re right. It’s actually not all banks as for example Steward Bank is not on this platform yet. Updated the article to reflect this.

Strange though that Barclays are not receiving ZIPITs. To the best of our knowledge, they are active on the receiving but not on the sending.

FYI: Mobile money and mobile banking aren’t the same thing. Mobile money is un-banked, where the service provider gives you a mobile “wallet” to hold your money. Without a SIM from the provider of the service you cannot use that service. These services are also generally transfer oriented, rather than transaction oriented. Mobile banking, which is what you are describing, is accessing your banks services via a mobile device and is not necessarily USSD based e.g, Barclays has an Internet based mobile banking app. Mobile banking, is more information oriented, e.g, balance enquiries, transaction history and card management. In as much as transfer services may be provided, they are neither realtime nor guaranteed to go through. As well, transfers and transactions are sometimes subject to regular working hour processing cycles.

I think to the customer the difference is not there, and in the interest of simplicity, it’s more or less the same thing. Look at Texacash and EcoCash for example. With Lite Textacash account you can pretty much do everything that you can on an EcoCash account.

– Open account at an agent

– Deposit money at an agent

– Send that money to a mobile phone

– check balance via mobile phone

– buy airtime & pay other bills etc…

The distinction that you talk about exists clearly (even to the customers) when you compare mobile money to traditional (as opposed to Lite) bank accounts.

The difference to the customer is there. Can you transact on EcoCash without a active cellphone/SIM? Can you transact on EcoCash via the Internet? With Internet enabled mobile banking apps you can do both those things. With the Barclays mobile app you can transact on your account in Afghanistan, so long as you have an Internet connection. Let’s see someone EcoCosh from outside our borders.

Mobile banking provides an alternate method to access your banked money, whilst mobile money is the sole way to access your money/wallet. As such, mobile money cannot exist without a cellphone/SIM, if your phone is dead there’s no transacting till it’s up again.

And to correct you, Textacash is a Cabs product that is a mobile money service rather than traditional banking. A Textacash account is not a regular Cabs account. A pre-requisite to opening a Textacash account is that one MUST have an active mobile number, classifying it as a mobile money service NOT mobile banking http://www.herald.co.zw/textacash-offers-financial-inclusion/. The Cabs mobile banking service (for it banked clients) is provided seperately, http://www.cabs.co.zw/sme-banking/channels/mobile-banking which is what you should have compared against EcoCash in your misguided comparison. A little research goes a long way 😉

No. But this is something that EcoCash customers using their app are constantly complaining about. Technically I’d say that’s something Econet needs to solve.

Again, technically, this is supposed to be possible, but like EcoCash, banks haven’t enabled ZIPIT via their internet preferring instead to just activate the USSD channel. A few have done apps, thankfully.

I’m in Botswana right now and can EcoCash, albeit via roaming. The wider point is that these are technical details that both Econet and banks are trying to abstract because as a customer, I should not have to deal with a technical list of what i can and can’t using a service for. I should just be able to transact on whatever channel (app, internet, USSD, card) without worrying about technical implementation. The good thing is that operators themselves realise this and are continuously working to blur the differences. the Econet Mastercard, or myZaka Visa card here in Bostwana are an example. You don’t have to worry what’s behind the visa, you just use it like any other Visa/Mastercard.

– the article says “There’s mobile money service that almost all banks offer.” and that customers that don’t have a bank account can sign up with just their ID. it gives Textacash as an example.

– You comment arguing that it’s not mobile money but mobile banking

– I respond to your comment showing you how Textacash and EcoCash are not much different, and therefore both classifiable as mobile money

– You respond to say that Textacash is mobile money.

I guess we agree.

The risk is getting stuck on technical definitions when, to the customer, it’s all financial services. And when to an operator or banker, the current effort is to rid those few differences which confuse the customer. ZIPIT, in my view, is part of ZimSwitch’s wider push to remove those differences. They can’t not connect to traditional bank accounts all in name of keeping it a pure mobile money service. So it’s a mobile money (Textacash) and mobile banking (traditional account) hybrid? so what?

ZIPIT can access both Lite and Traditional bank accounts. To argue that it should be termed one thing and not the other is getting hung up on definitions for the sake of it, and I see no progress in that when trying to simplify the message to the reader.

You seem to have misunderstood the Textacash vs Cabs’ (Real) Mobile Banking part of my comment. Anyway, I won’t dwell on that because that isn’t my core issue.

Back to the core issue: Technical details are important, as well as remaining technically correct. Readers get confused when people switch terms at their own discretion. If a reader is confused, surely, they can ask for clarification.

I’m a reader too and to me, when you mix up terms, it means that you don’t understand what you are talking about. Oranges are oranges, lemons are lemons and limes are limes. When you talk citrus, you are free to talk about these 3 and more, but when you are talking oranges don’t include lemons as a type of “bitter” orange.

You shouldn’t undermine the intelligence of your readers by assuming they aren’t sharp enough to understand the details. You managed to understand them, so why can’t we? You can look at it which ever way you want, mobile money and mobile banking aren’t the same thing. You are free to compare them, but not to define them to be the same thing.

If you are roaming you can do it from outside the country!

Went to my CABS mobile money, *227#, no ZIPIT option. Only have Banking, then Transfer on next menu where you can send money to other bank accounts. Confirm would this be ZIPIT or regular RTGS? Can you have CABS mobile banking without Textacash? Maybe I need to register for Textacash?

The transfer you see is Likely ZIPIT. but just ask them to be sure.

I think this is a clarity problem that the banks and Zimswitch have not done enough to solve. For example, when I’m transferring money via the internet, am i using RTGS or ZIPIT. Turns out it’s RTGS but the bank doesn’t make that clear and yet there’s a big difference in fees. Same as mobile and in-app transfers. It’s confused really and in the end the customer just keeps away

If the bank charges are less, then I’m sure our banks would not want to advertise this option at all cause that’s how they’re ripping us off… Tried doing a transfer to my NMB account from CABS just to test it and it bounced with an error. Checked my CABS statement, it went out and back in and the charge was $1.05 so I am assuming it is ZIPIT.

Does Steward Bank have this service

To the best of our knowledge, they don’t offer this facility yet

ZB Bank can sent and receive

didn’t have any such information. Will verify and update.

Would be prudent to update the article because ZB uses ZIPIT through the Pauri Khonapho Card

This may not be the best place for a suggestion but would TechZim ever consider doing an article comparing bank and mobile money charges in the region to Zimbabwean banks? I.E. Monthly maintenance fees, swipe charges and interbank and mobile money transfer fees… Would be interesting to see how different the banking models are and how we are being ripped off here, even with the new revised fees.

Someone sent me money to my phone via ZIPIT. Now I need to go to an agent to get it and didnt get any joy at FBC Banks. Which other banks are agents of ZIPIT?

what happened to Stanbic ZIPIT? The option used to be there on the Stanbic blue menu but nowadays only the RTGS option remain.

hey won’t ask for your grandmother’s birth certificate. All you will need is your ID.

hahahaha who is dead at the point of time

How does ZIPIT to cell work? In a case where the number is registered to ecocash and a bank like Barclays, which doesn’t have this facility. How can a person receive and retrieve the money.

I heard there is a function where if you do not get the money after a certain amount of time it is reversed. How does that work too?