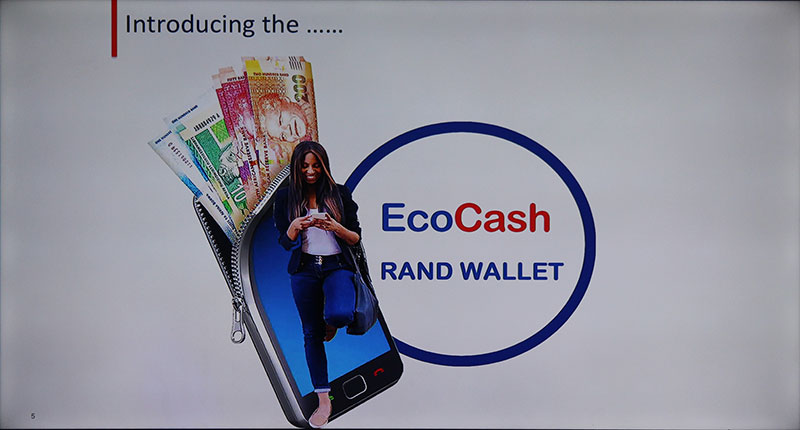

The EcoCash team has a two-pronged value proposition for the introduction of South Africa’s RAND currency into its mobile money system. The first phase of its introduction includes:

- Cash-Ins

- Cash Outs

- Sending Money

- Wallet Services (Balance Enquiries and Mini- Statements)

- Merchants, Bill payments, Payroll (you could start getting paid in rands!?) and Bulk Payments

EcoCash expects its new Rand wallet system to expand over time as more users take up the new system and plan to offer more services through its second phase which includes offering customers:

- Rand Remittance services

- Airtime

- Banking Services

- Card Services

- Payment of online bills (DSTV, ZESA etc in RANDS)

The first phase is already in effect, users can enable the RAND wallet on their EcoCash right now, the second phase may come in the next 6 months as we can imagine there would be quite a lot of legal workarounds and system integrations needed to be done to get the services up and running.

Although the first phase has caught many of its customer’s attention, we think the second phase will be more exciting as it adds more value added services to the new Rand wallet system.

Of interest would be whether the RAND payroll system already in effect means that people could start receiving their salaries in Rands? We know of quite a few companies that use EcoCash payroll for salaries and if their operations are South African based this could come as a relief to both the employers and workers as USD becomes scarce in the Zimbabwean Economy.

The RBZ is fully aware of EcoCash new system and has approved it as part of its drive for 90% Financial inclusion by 2020, the RBZ were in attendance at the event offering their full support to the new initiative. Below you can find passages of the RBZ statement at the unveiling this morning:

Payment systems are pivotal in any economy given their role to facilitate the intermediation process which is key to achieve financial stability. To this end, the Central Bank will continue to ensure that payment systems are operated safely, efficiently and soundly with effective consumer protection mechanisms.

As you might be aware, the National Financial inclusion strategy (NFIS) launched in March 2016 is anchored on four pillars, namely financial innovation, financial capability, financial consumer protection and microfinance

The launch of Ecocash Rand Wallet will therefore go a long way in our efforts to achieve the overarching financial inclusion goal in the country where by 2020 we should reach 90% financial inclusion rate

You can download the full statement Ecocash Rand Wallet Launch 8 December 2016.

8 comments

So if i transfer money from bank to wallet (Ecocash banking services )does it mean the money will be turned into Rands, if m using rand wallet

You can’t deposit USD into a rand account. That’s like, the laws of feminism (read the preceding article on how to activate rand wallet for more details)

True that, I called EcoCash and was told that there are no banking services as yet on Rand Wallet.

I folloewd the steps which you gave to activate the multi-currency, BUT there’s no option for the Rand wallet

It sounds like a clever way of insulating EcoCash users from bond notes.

No where to run my friend – once there will be no more dollars on the market, RBZ will simply introduce Rand bond notes and coins. They will be pegged at 1:1 with the Rand and will operate from the same account.

However, EcoCash clients cannot transact from a United States wallet to a South African rand wallet.

This is clearly a way of econet rejecting and insulating itself from the toxic currency which is the BOND NOTE. Its so eloquently clear that a parallel monetory system is being set up by RBZ on one side and econet on the other side. The people that will pay the prize are the povo. In 3 months no USD will be in circulation and all serious business transaction will migrate to ecocash. The country’s economy will be in hands of econet. This is not econet’s fault at all. The stupid zanu pf goverment cannot even see this at the moment as Mboweni sweet talked them with stuff like.

Econet Wireless CEO, Douglas Mboweni said the introduction of a multi-currency wallet was another step towards meeting the country’s vision of becoming a cashless society and of easing liquidity in a multi-currency regime.

This is clearly Econet capturing state resources and institutions because of its economic dominance and corrupting state officials who do not even see beyond their fat nose. Just wait, come 2018, the govt will be wrestling with econet in courts over this deal.

We are witnessing the beginning of an abandonment of yet another worthless Zimbabwean currency. Just as happened in 2009, it is the povo with money in the bank, salary arrears, unsettled financial disputes or cash in the form of bond notes who will lose out. As Rand transactions dominate, the RBZ will once again become irrelevant (not a bad thing) and the economy will improve but I fear not for long. The RBZ will once more hijack the Rand settlement system and inject toxic fictitious electronic balances and possibly Rand denominated bond notes and coins and everything will be back to square zero.