It’s important for every company that is spending money on marketing / ‘customer acquisition’ to be able to predict how much money they will make from every customer that walks through the door, in the customer’s lifetime (that is as a customer). This is so that companies don’t spend more to acquire the customer than the customer will actually give them.

“Half the money we spend on advertising is wasted; the trouble is we don’t know which half “.

This quote (attributed to 19th century American retail merchant and marketing pioneer, John Wanamaker) captures the frustration associated with measuring Return on Marketing Investments. Customer Life Time Value (LTV) helps us at BitFinance to measure the financial performance of marketing, and directs the efficient use of capital, for the purposes of capturing value from customers and creating value for our company.

What’s a customer ‘Life Time Value’ (LTV) and why is it important to us?

A customer’s LTV is a prediction of the net profit we will get from the customer throughout the entire future relationship we will have with that customer.

Customer LTV is important to us because BitFinance is a for-profit organisation and because customer interactions (through customer support and/or marketing) cost us money, we want to assess the profits we derive from our interaction with our customers and whether, through this interaction, we’ll end up with a profit when all is said and done. The LTV is therefore a futuristic metric to assess how valuable our interactions with our customers are in the future.

The LTV also helps determine:

- The upper limit on what our company is willing to pay to acquire a customer.

For example, if our LTV is $100 and we decide to spend $1000 on a marketing campaign on Facebook. If that campaign brings in 20 customers, then each customer cost us $50 dollars to acquire. That money was well spent because we’ll make a $50 profit from every one of those customers. It won’t make sense for us to spend $150 to acquire a customer when our LTV is $100. - An upper limit on what our company is willing to pay to avoid losing a customer.

In other words, a customer is an asset and the LTV represents the dollar value of that asset – e.g. if our LTV is $100 and we think that giving our customer a $25 t-shirt will keep them loyal then we’ll go for it. - How to tailor your product for our best customers.

If your company is generating revenue, you’re likely making 80% of your revenue from 20% of you customers. Because we realise that not all customers are equal, at BitFinance, we segment our customers and give different LTV’s to each segment. We will not only spend more software engineering time on the customer segment that has a higher LTV but we’ll also spend more marketing dollars to reach that segment.

The LTV is therefore an important determinant of decisions we make regarding customer acquisition, advertising and product development.

How we calculate LTV

There are a plethora of ways you can calculate LTV. The best one for you depends on your type of business and who your customer is. If you do it differently than us, please share in the comments section below how you do it differently (it will be good to compare notes); Here is how we do it at BitFinance:

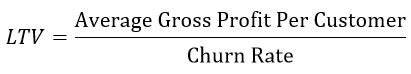

We take the average revenue we earned from a customer, subtract the money we spent on acquiring and serving them and then divide the figure we get by the churn rate – i.e. the rate at which our customers cut ties with our company during a specific time period (case in point: one month).

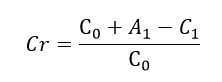

When we calculate churn rate, we call all the customers we group together in one month, a cohort. We use the following formula to calculate churn rate:

Where:

Cr = Churn Rate

C0 = Customers acquired at the beginning of the period

A1 = Customers acquired during the period

C1 =Customers at the end of the period

Throughout history, technological inventions such as the printing press, the radio and the television have made it more efficient for companies to allocate and use limited marketing resource to create and capture value but none has had a bigger internet than the internet and the world-wide-web. Add to this that humanity now understands the scientific method, so start-ups can now measure/predict economic returns and make sure they are greater than the cost of capital employed. Technologies such as the internet, and the scientific process have made the world a better place.

What do you think about the use of Customer Life Time Value as a metric in an organisation? Let us know in the comments below.

This guest article was authored by Panashe Tapera, a financial tech enthusiast and is entrenched in the cryptocurrency community. He is an accountant at BitFinance. BitFinance is a local Bitcoin exchange startup.