BitFinance, one of the few digital currencies startups in Africa, is now offering more than just bitcoin on its BitcoinFundi exchange. The startup has added Litecoin and Dash to its digital currencies. Since they launched the exchange about a year and half ago, BitFinance had been trading bitcoin only.

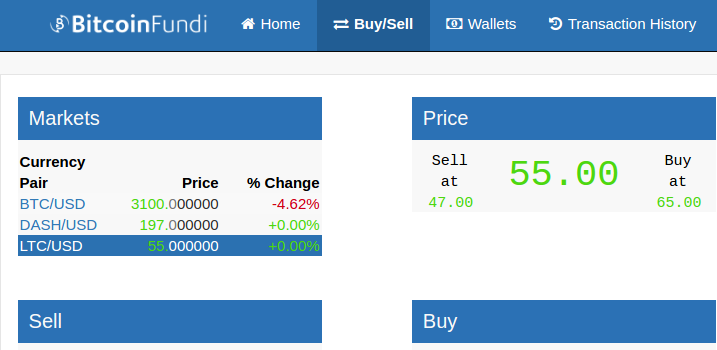

I logged into my account today to find Litecoin priced at $55 and Dash at $197. These prices are generally the same you will find globally. Eventually the expectation is that, like bitcoin (valued at $3,100 on BitcoinfFundi against a global average of about $2,550) the price of the two new cryptos will gain a local premium if demand increases.

In their announcement BitFinance told us:

“We are scaling our exchange services, providing more scope and widening the number of crypto-currencies available to those interested in digital assets. Until now, only Bitcoin trades were possible. These additional currency options are in line with our strategy as we scale up our exchange and its offering. This is also in line with our overall pan-African expansion plan.”

Litecoin is similar to Bitcoin in many respects,. The key difference is that transaction blocks are processed every two and half minutes compared to Bitcoin’s ten minutes. Additionally, unlike Bitcoin which has its maximum possible production of coins capped at 21 million, Litecoin’s total possible coins are eight-four million.

Dash is also a peer-to-peer crypto-currency with features similar to Bitcoin but with capacity to process private and instant transactions. The currency has a decentralized governance and budgeting system making it what’s called a decentralized autonomous organization (DAO).

Both Litecoin and Dash in the top 6 cryptocurrencies in the world right now by market cap, at position 4 and 6 respectively.

Generally, there’s been a surge in the price of digital currencies this year apparently because of the acceptance of bitcoin in some countries, most notably Japan. The media coverage of the changes and perceived opportunity of speculating in cryptocurrencies has also contributed to a rush which has helped drive the price up.

The price of a bitcoin for example has risen from $1,000 in January this year to about $2,550 today. The Litecoin price has shot from around $4 in January to $42 today. The Dash growth has been one biggest (about 1,700%) from just $11 in January to $198 today. Other top cryptocurrencies like Ethereum ($9 to $205) and Ripple have similarly surged in price in the same period.

Those numbers are crazy right? They are. So much so some analysts are warning that it’s all just a bubble and that people buying cryptocurrencies are at high risk of losing all their money when it all crashes and burns. In Zimbabwe especially, the conventional advice I hear at events is “don’t use bitcoin as a store of value, but just a means of transacting”. Despite this some see investing in bitcoin as a better bet than leaving your money in your bank account or in local common currency.

Comments

7 responses

This is a very welcomed development!

Thanks. We’re no longer call ourselves a bitcoin company. We’re now a digital currency company.

Tawanda Kembo

How to get into contact with you as a crypto currency partner? I tried to connect with you on LinkedIn and they requested your email. Please look me up on LinkedIn and connect.

Great stuff

awesome, any plans for a android app anytime soon, bitcoin trader/owners are most likely to own a smartphone so i think it will give a lot of convenience to people who use ur exchange

Naturally no mention of the recent hack on Ethereum…with hackers stealing $32million worth of the currency. Not the first but the second.

http://www.businessinsider.com/report-hackers-stole-32-million-in-ethereum-after-a-parity-breach-2017-7

Not to also forget the epic and infamous $500million Mt Gox heist

http://www.thedailybeast.com/behind-the-biggest-bitcoin-heist-in-history-inside-the-implosion-of-mt-gox

It is prudent to educate, inform and assure on risks involved.

Not to alarm or scare people.

By the way, regardless of the Ethereum hack, the SEC is recognising tokens as securities

So you reckon an article about the addition of Litecoin & Dash to an exchange should suddenly morph into an unrelated hack on ethereum wallets? How is that related?