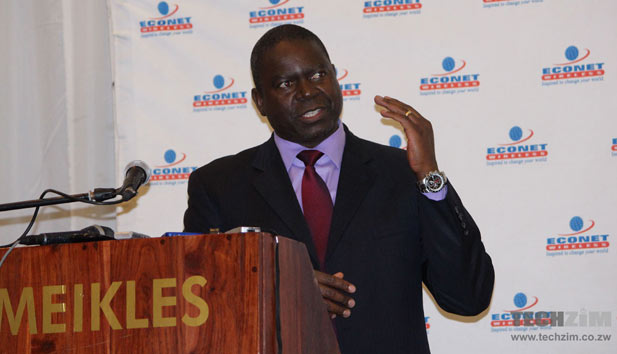

Econet Wireless has pronounced a firm refusal to back down on it’s demand on banks to pay a tariff of 30 cents to gain access to its transaction messaging system. This is according to a report in The Herald that quotes Econet Chief Executive Douglas Mboweni reaffirming this stance.

According to the article, Mboweni insists that the disputed tariff conformed to regional rates for system access despite the outcry from several banks that the tariff is prohibitive. He highlighted how banks have to choose between either the USSD platform or integration with EcoCash. He emphasised the point that banks will not be granted access to the USSD platform unless they paid the prescribed tariff.

Although this appears to be unfair play from the network, Mboweni argues that as they set up the infrastructure they cannot be told by someone seeking their service how much to charge for it. Banks have expressed concerns that the rate makes mobile banking expensive and denies the consumer the convenience of mobile banking.

This dispute between local banks and Econet has been playing out for a while now, with banks having gone to the extent of reaching out to State legislation for intervention in dealing with Econet’s “monopolistic tendencies”.

Econet however does not seem to be bothered, considering that ten banks have already integrated to its EcoCash system. This shows a compliance with a player that has already established an impressive dominance of the local mobile money transfer space. At a tour of its operations by legislators last week, Mboweni mentioned how EcoCash had processed $4 billion since 2011.

At the moment it doesn’t seem as if any action, legislative or otherwise, will be taken to pin Econet into submission regarding this issue. Besides going back to the drawing board and coming up with a competitive product inspired by prevailing trends in technology, the only other option is to play by Econet’s rules.

Comments

13 responses

I think it is high we had some serious competition to EcoCash. Only way to disrupt the market

all the best buddy..meet you in the market.

Matter fact, why dont you start with Internet Banking. I want to pay DSTV via the net, and buy ZESA too. I pretty much think that is a better way of earning your clients’ attention.

taura hako iwe , banks dont think

ma banks akarara too much

True, and its something the banks seem to be forgetting. Innovation doesn’t mean you have to go through Econet’s products. From my experience, customer loyalty tends to thin out if competition beefs up. Make something nice and we will follow.

Ever wondered why mobile money transfer failed to take off in countries like S.A, and totally ignored in ‘developed’ countries? Its because the banks are highly accessible to the urban populace. And they didn’t need USSD access to achieve that either.

With all this disconcerting habit Econet is just a nagging pain to BAZ (Bankers Association of Zimbabwe)

I thought it is the other way round, actually: the banks being a pain to Econet. After all, it is Econet’s product they are all after.

I think this calls for us to go to the banks and telling them that the $ervice fees that they are currently billing us are high and that they need to review them downwards too!

Yeah, we pass thru ZIMRA and ask them to review Car import duties as well.

tora mari econet , ma banks anoda zvaka cheaper

in business we pay.

mabanks anotirova pasi petsoka wani

XXX@123.com

l would like to say personally. l do not feel sorry for the banks. l think this problem is one of their own making. Firstly banks in this place are too slow to move, that is why Econet was able to come in with a product which caught them out.

Secondly these banks are the same for whatever business case turned away some of these people who have resorted to ecocash. l think signing up for a savings account or any account for that matter seems to be a favour by the bank to you, judging by the way they make you grovel to get what really should be an ordinary product.

l will give an interesting example, in China you can open a bank account for less than 20Yuan let us say 3/4 dollars and this takes just about an hour wherein you will also get the card, can opt for real internet banking, phone banking and other services. Contrast that to the come back after…. routine which is prevalent here. Let us not even start to talk about other services.

l also wonder who in their right minds would actually keep money in a bank. Granted inflation is now under control but these banks for as long as l can remember always paid us a negative return. That is the interest is far less than the rate of inflation. Which means actually the longer your money stays in the bank the less you have in real terms. However, their interest and profits have always been way above inflation, l suppose we should give them plaudits for at least being business savvy in that regard.

Add to this are the usurious service charges, l believe it is possible to leave $100 in an account and after say about a year assuming you have not touched it in anyway and you may actually have less than the $100 you began with due to ‘service charges, transaction fees, account management fees…’ So i ask again why even have an account seeing as now you can access your salary via ecocash or do business via ecocash. Maybe for the very large businesses banks still offer some valid services but for the average man on the street they have fast lost relevance.

On another note, l recall when Gono first became the governor he once talked of having a situation where after all the service charges etc if you banked your money the net result would be you would be better off than when you began but l wonder whatever happened to that very good thinking. Maybe another case of ‘regulatory capture.’

Lastly in the 90s there was a time the courts were trying to push for something l think was called the ‘in duplum ruling’ please correct me if l am wrong. lf l recall correctly this was supposed to stop you paying back if you borrowed from a bank more than what you borrowed and the interest you should have paid.

l think it is fair to say sometimes the banks will make you pay 5 or more times what you were meant to pay due to the way they compute and manipulate the loans, balances and interest payments. l do not recall what happened but given the might and resources of the banks l do not think the legislation or rules ever came to pass.

Therefore to me banks have never had the interests of the ordinary person at heart. Maybe l am generalising but l think the small saver is actually the most taken for granted aspect of banking yet by their sheer volumes alone they may really be the ones giving the banks most of their business.

For me l recall a very bizarre situation which occurred in the mid 2000s. At that time l was a student in one city but had grown up in the other. CFX/Century Bank (l have forgotten) which l banked with happened to run into difficulties. They gave us two weeks to go back to where we originally opened the accounts to claim our money. As this was the time of cash shortages and other problems, needless to say l never saw any of my money. lt would have cost a great deal of time and money to go back and return. Why we were not allowed to go to the nearest branch to get our monies l will never know. Anyway this and other acts by the banks have made feel and think negatively when it comes to banks in general.

So for me l am extremely delighted that someone else has come to our aid. The banks have had it too easy for a long time and they really have been extorting us. l hope the emergence of Econet as a financial player will ultimately lead to a more customer focused way of doing business, unlike the current model where customers are just an unnecessary impediment which must be dealt with the least care or cost. For example why is it that banks don’t want you in their service halls if they ‘value your business’ so much?

i have never felt this much joy.

The anti-Econet revolution is starting and I am at the forefront.

Econet is Zimbabwe’s Microsoft. We all hate Microsoft, but we all use it.

Proudly Econet Hater

eeeh, mungwarire kuti muchagona kukuza n’anga neinobata mai.

Econet has evolved into a virtual monopoly. Right now they are offering products that are marginally better than what its competitors provide simply because they want to muscle out the competition; you can be sure that once the competitors have been nudged out of the market you will get the same arrogance that you currently get from the banks themselves.

Econet has never had a customer-centred approach, they have a customer-pocket-centred approach.