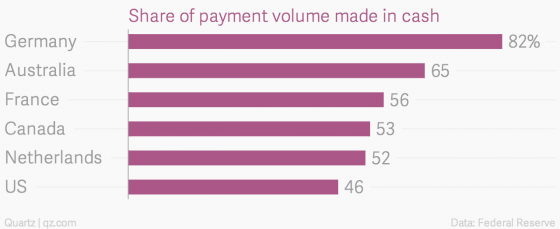

We came upon some figures about the use of cash vs cards (and mobile money in our case) in other countries and it made for some interesting reading. According to a recent study about 82% of all transactions in Germany are conducted in cash.

The study was covered in a report by Quartz, which helpfully broke it down in this chart:

This study is interesting because in Zimbabwe now, the Reserve Bank of Zimbabwe says only 20% of transactions are still made in cash.

But what is even more interesting is the shared history that Zimbabwe and Germany have as far as the stability of money goes. The Quartz report notes the reasons for the strong appetite for holding one’s cash in Germany:

One explanation is that, as researchers have found, memories of hyperinflation have quite a bit of staying power. People in countries that suffered banking crises quite sensibly often prefer to save in cash—though typically in foreign currencies such as US dollars—rather than put money in the bank. (Federal Reserve Bank of New York economists found that demand for US dollars rises for at least a generation in countries after they suffer a searing experience with high inflation.) And countries such as Bulgaria and Romania, which have recent histories of currency instability and financial crises, also are quite heavy users of cash.

In short, it’s no wonder that even though there’s no cash at the banks, Zimbabweans still queue everyday, and some sleep at the banks to hold a near position in the queue, just so they can access their cash.

Retailers would rather get their money in cash and really only accept electronic payments because the government has made it illegal not to. The informal traders at markets like Mbare and Siyaso are clear that they’ll only accept cash unless you’re prepared to pay more to transact electronically.

Like the Germans, Zimbabweans prefer cash primarily because they have a memory of the devastating effects of hyperinflation. In 2008, our annual inflation reached 89.7 sextillion and when it all eventually collapsed, people lost all their savings. Their money in the bank became nothing, and if this report is right, it’ll take another generation before Zimbabweans can trust again.

Comments

5 responses

We are headed for another round of hyper inflation. The familiar signs are all there. Intial issue of bond notes seems to have evaporated into thin air. RBZ is said to be printing some more $300 million worth of bond notes. They say it’s madness doing things the same way over and over again hoping for a different result. Real value of money is in the faith people put in a particular currency. The trust comes from inclusive economic and political institutions and extractive institutions breed fear and mistrust. Until our institutions are inclusive forget about economic recovery with it financail stability. We are going to go through elections motions next year when we can least afford to fund the elections…it is desaster in waiting. Just wait and see.

LOL comparing Germany with Zim… Joke of the century. How pathetic.

Not sure I get you

VERY INTERESTING INDEED. AND LUCK FOR GERMANS NO ONE IS THREATENING THEM WITH ARREST FOR KEEPING THEIR CASH

I am an 80 year old German; so I didn´t live at the time of our big inflation (1923). I am used

to save cash at home – but of course not in US-Dollars. I am sure that only bankers know, how bad the US-Dollar is at present. A few years before I bought a Zimbabwen banknote as

I think 100 Trillion Dollars is the highest note ever printed. For the sake of US-Citizen I hope

that the US-Dollar is still a little bit better than this Zimbabwen note. – I fear that the US are producing far to many weapons and Dollar banknotes as well. Both is wrong. – By the way the word Dollar comes from the German word Taler, which were coins in Germany some hundred years before.