There is a lot you can criticize President Mnangagwa’s administration for. Inaction is not one of them. Let us evaluate the administration’s moves as they are presented to us and see whether they indeed can achieve what they are meant to achieve.

The president has been saying he wants to make Zimbabwe attractive to investors. He is yet to reach two months at the helm but he has set the tone for what his administration is all about. In what we have seen and heard so far, can we say it is in line with opening Zimbabwe’s doors to the world and attracting foreign investment which should help revive the economy?

It certainly looks like that’s the case. One of the first things done by this presidential administration was to scrap the investor-chasing Indegenisation Act. That controversial Act required any foreigner investing in Zimbabwe to give up control (51%) of their company as if Zimbabwe was not unattractive enough without it.

Lower Corporate Tax

Now the government is looking to make Zimbabwe even more attractive. Not only can a foreigner now hold on to 100% of their company, except in a few cases, they can also look forward to paying lower taxes.

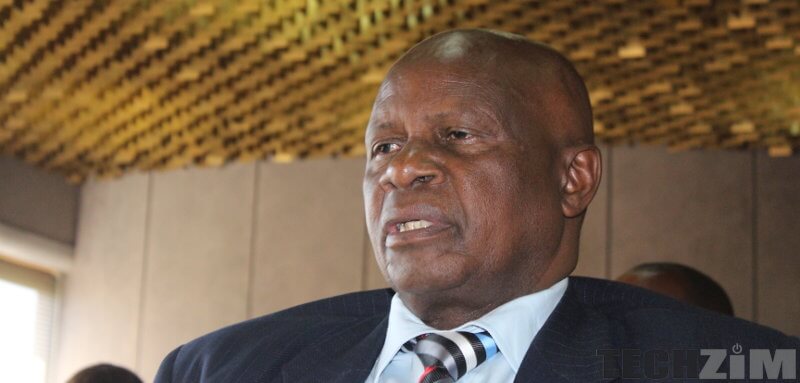

The Minister of Finance and Economic Planning, Patrick Chinamasa accompanied the President on his trip to Namibia and while there he had to respond to some who contributed that the country was losing out on investment opportunities due to comparatively higher taxation. He responded,

Taxation, I agree with you is too high. It’s a matter that we are going to address so that we can proceed to a position where we get more taxes from more volumes.

He did not shed light on which economic players should expect reduced taxes. Are we talking just corporate tax or are we looking at Pay As You Earn (PAYE) too? We can be sure that corporate tax is to be revised given the context in which he mentioned that taxes are to be revised down.

Is lowering taxes a good move?

It does not take a rocket scientist to see the appeal in lower taxes for a company. The lower taxes will help in persuading investors to choose Zimbabwe over other countries. What impact will the lower taxes have in Zimbabwe though?

Lowering taxes is not a guarantee that investment will flow into the country. Once taxes are lowered ZIMRA will collect lower revenue for a bit of time, until businesses already in Zimbabwe are able to expand operations, boosted by tax savings and also foreign-owned tax paying companies are set up.

Now you don’t need reminding that Zimbabwe is a serial deficit budgeter. This means year in and year out the budget presented has expenditure topping revenue. To grasp this, imagine someone who earns $3,750 a month and yet his budget has expenses reaching $5,950. This person is short $2,200, that is his budget deficit.

That is Zimbabwe’s budget deficit simplified. In 2017 revenue collections reached $3.75 billion whilst expenditure reached $5.95 billion according to some parliamentarians. That puts the 2017 budget deficit at $2.2 billion. In Minister Chinamasa’s 2018 National Budget the deficit was calculated as $1.7 billion.

Now you see that our expenditure already exceeds our revenue. Lowering taxes lowers revenue because that is the government’s main source of income. As we pointed out, the lowering of taxes is no guarantee that investment will flow and even if it does, ZIMRA will still be collecting less revenue for a while.

So the lowering of taxes worsens the budget deficit, in the short term at least. The government is looking to cut on expenditure but it’s not likely to offset the reduced revenue. This is no problem if we are all clear that this strategy will be a long term strategy. Problem is I see people already complaining that Zimbabwe has not been fixed yet so it will be interesting to see how it all pans out.

I know for a fact that Minister Chinamasa only said that the government was looking to lower taxes when asked about the taxes. The National Budget he presented makes no mention of projected lower revenues. Some parliamentarians are actually accusing him of understating the country’s budget deficit, and that was not taking reduced revenues into account.

Is Zimbabwe’s corporate tax comparatively high?

Another question to ask ourselves is; are taxes in Zimbabwe that high, comparatively? The effective corporate tax rate in Zimbabwe is 25.75%. Let’s look at some countries in SADC:

Zambia – 35%, Mozambique – 32%, Namibia – 32%, Malawi – 30%, Swaziland – 30%, Angola – 30%, South Africa – 28%, Lesotho – 25%, Botswana – 22%.

As you can see, only Botswana and Lesotho have lower tax rates than Zimbabwe, 3.75% and 0.75% lower, respectively. So it might be time to drop the Zimbabwe having a comparatively high tax rate argument.

It is evident that high tax rate is not the reason investors were passing on Zimbabwe. There were many reasons, chief of which were the political instability and unpredictability of the Mugabe regime. The Indegenisation Act was up there too.

If we are going to be lowering taxes, let’s do that knowing that it is only to sweeten the incentive for potential investors. A low tax rate is not the highest item on the list for potential investors. Things like being able to repatriate profits and corruption levels rank higher.

Election season is upon us and this is the time to be skeptical about absolutely everything politicians say. Minister Chinamasa only mentioned the plans to lower taxes after being asked about the high taxes in the country. His National Budget has no provision for the lower taxes. Could it be that he only said that to pay lip service. Or maybe this is something they were actually working on. You decide.

8 comments

We wait & see. There are certain decisions that the present regime has taken that defile logic, albeit it short existence. Focus on this last week: govt is short of money. But it dishes out hundreds of twin cabs to chiefs. How many govt depts are short of vehicles & other usables? If the idea was to give chiefs vehicles at all cost (this was political expediency at play), how about utility vehicles like Nissan NP300? With such wanton splurging, is govt going to control the budget deficit any time soon? Do they ever look at the bigger/national picture before squandering resources in just one slice of the expenditure pie? This ties in with your question: Is reducing tax a good move?

is it not high tax that make Zimbabwean fuel the most expensive in the region

The cost and the process of starting a business in Zimbabwe is cumbersome and very expensive. You have to go to every gvt office for licensing and the license fees in most cases are very very high

There are many government taxes and levies that push up costs of production in Zimbabwe wc makes us an unattractive option… in addition to taxes we hve lots of bureaucratic hurdles that hinder business practices

let them zimra has a choice to either jeep the current tax rate and revenue or to get the Same revenue or more by freeing Monet for expenditure with lower taxes

and also we work in pure us dollars the other countries can control the tax rate effect by monetary policy devaluations etc. if you were to put it us dollar terms all other countries have lower taxes

Corporate tax is not the only consideration when investment decisions are taken. There is the ease (or rather, the struggle) of doing business, profits that cannot be repatriated because of forex shortages, an economy whose fundamentals cannot support a local currency, unconventional property rights etc. Forcing 99-year land leases (whether transferable or not) collateral on banks scares both domestic and international investors. Reverting back to the conventional collateral of title deeds that every investor is comfortable with would mean that the Chefs and their extended families that got the farms would have to pay a reasonable price to the dispossessed white farmers,or the state.

Am yet to see Chinamasa’s ability to juggle income and expenditure in innovative and effecient ways. If they cannot be prudent and shrewd with the what they get then lowering taxes will not be a ready option as they will not know how to manage lower revenues.