Minister of Youths, Sports, Arts, and Recreation, Kirsty Coventry has decried the way the youth-centric Empowerbank is being run. Her criticism came after it came to light that the bank has way more employees than the number of loans it issued. Since 4 months ago when it was launched to rave praises by the government, the Empowerbank issued 15 loans yet it has 47 monthly salaried employees. To which Kirsty Coventry remarked (according to newZWire);

To see 15 loans being loaned out and with such high salaries is not acceptable

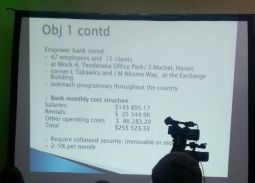

Here is the snippet of Empowerbank’s financial statements court (courtesy of newZWire);

To begin with, you may be wondering by what right Kirsty Coventry wants to interfere in the running of Empowerbank. Its because she’s the Minister of not only Sports but of Youth as well (and Arts too) and since the Empowerbank is for Zimbabwe youths, it falls in her purview to interfere.

The Minister is justified with here criticism because when you come to think of it, it doesn’t make sense that in 4 months Empowerbank has just made 15 loans. At a time when local startups and Small-to-Medium Enterprises are in need of funding, it’s appalling that the bank that was tasked to serve ‘youths’ in these businesses is lending at such a pace. What, the tight lending practice rule that is now common across all banks has caught up with the Empowerbank as well? If they are already practicing such a policy then the chances of scaling faster are limited. Naturally, you would expect that in the early days of a bank that’s when it will be dishing out loans to attract customers, but what Empowerbank is doing is unheard of.

Maybe Empowerbank loaned out all its loanable money to those 15 clients. That would mean it loaned high-value loans to the 15 clients. But wouldn’t that be foolish? Because logically, like in every business, you should spread your risk. In the case of Empowerbank, the risk would be spread by loaning out small-value loans to many people/organizations rather than just 15 people/ organizations.

Minister, Kirsty Coventry should keep an ‘unblinking’ eye on this bank because like many things government-related its prone to be poorly run. The bank could be medium to success for many young Zimbabwean entrepreneurs if properly run.

Comments

One response

There could be too many empowerment banks and initiatived- youth, women, crossborder’ SMEDCO and so on. The same objectives could be realised through special windows under one roof cutting down on overheads in a multiplicity of institutions.