Steward Bank has built on the previous week’s momentum to add another feature on it’s *236# platform. This morning Steward Bank unveiled an instant foreign currency account, called The Dura Foreign Currency Account (Dura FCA). Just as how instant it is to open a bank account on the *236# platform, so is how easy it is easy to open the Dura FCA-just 60 seconds.

The Dura FCA is an innovative feature because you are spared the hassle of filling in ‘mountains of paperwork’ to have a foreign currency account. This is by virtue of having an EcoCash account (Steward Bank is the license holder of EcoCash financial services), Steward Bank knows you already hence the Dura FCA is KYC complaint. So now you only need to dial *236# and go through less than 5 steps (in 60 seconds) to have a foreign currency account. In essence, the Dura FCA is a KYC lite foreign currency account.

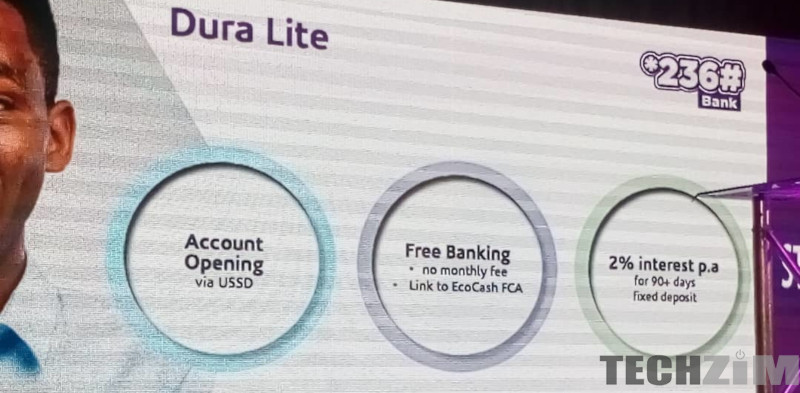

Types of the Dura FCA

The Dura FCA comes in two bits. There is the Dura FCA Lite and Dura Gold. With The Dura FCA Lite, you can open it on USSD *236#, you won’t get charged any monthly Fees and you get to earn a 2% interest per annum if you keep your money for 3 months and over. The interest rate is not that much such that it really entices you, holding other things constant, but it’s better because Steward Bank is actually rewarding (interest) you rather than penalize (no monthly charges) you for keeping your money with them.

Then there is The Dura Gold, which is pretty much like the Dura Lite except that there are monthly charges and there are no transaction limits. But the ‘no transaction’ feature comes with having to visit Steward bank and fill out a few papers for KYC purposes. And on top of that, you can get Diaspora remittances in the Dura Gold FCA.

The overarching feature of both of these types of Dura FCA’s is that users will be able to do wallet to bank transfers and bank to wallet transfers for Free. The bank we are talking right here is Steward Bank and the wallet we are talking here is the EcoCash FCA. And as I have mentioned before, Steward Bank and EcoCash work together (they of the same blood-Cassava Smarttech) that’s why the wallet to bank transfer (and vice versa) is free.

The combination of the easiness of opening the Dura FCA, no monthly charges, earning interest, receiving remittances and free bank to wallet transfers (and vice versa) is a good recipe that will make people fly to opening the Dura FCA instead of opening with other banks.

7 comments

This is awesome guys.ndokut bank uku

Awesome guys keep the going on ….very impressive they way you do business even your services are provided smartly

How does it help people who are already in diaspora?

It can’t help someone from the diaspora and can’t open an account from the diaspora, only if you have received money through EcoCash in Zimbabwe before and have kept the same number. Only then will you be able to send money from the diaspora and their electronic system recognizes you.

I think you can open the account from the Diaspora. I have my Buddie simply here and I always transact from here in South Africa

It Cassava Smartech

Can I open a Rand account and can I do online transactions with this account ? I would rather they link with SA banks so that we can transfer money from this side