Towards the end of last year, Nedbank announced that its customers could open additional accounts via its *299# USSD. This service made sense because Nedbank already has its customers information on file. Opening an additional account, like a foreign currency account, shouldn’t require existing customers to visit a branch.

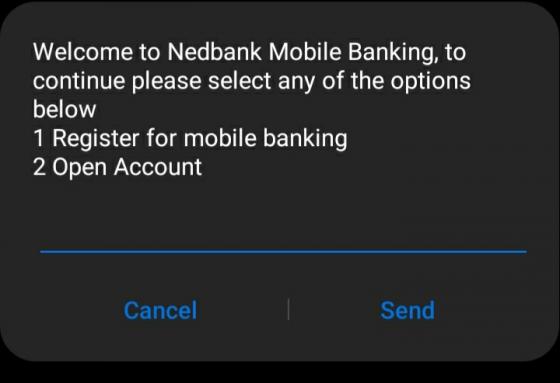

It appears that now non-Nedbank customers can open an account via the bank’s USSD. This is something I stumbled upon by accident, one day I was trying to access my account via USSD using my NetOne line which isn’t linked to my account.

After not getting a PIN prompt, I was curious as to why this was happening and then I realised that I wasn’t using the correct line. I then saw the “Open Account” option and I was both taken aback and delighted. By this I mean we hadn’t come across anything on Nedbank’s socials that suggested the service was up and I thought it might be something they are testing out.

We reached out to customer services to confirm if this was indeed possible and we were told that it was. All you need to open a Nedbank account via USSD is you, full name, ID number, address and date of birth. The accounts you’ll be able to open are Full KYC accounts which include foreign currency accounts.

After you have selected the account you want, you’ll need to select a branch and then you’ll get a reference number and confirmation saying the bank is processing your application.

Why is this important?

The one thing we went on and on about for the better part of last year was the ease to which people can open accounts. Facilities like the one FBC and now Nedbank have available reduce the barriers to entry for Zimbabweans to access financial services.

For the longest time, you could get by with a mobile money wallet. But with the transaction restrictions on mobile money, getting a bank account is a must and giving people easier ways to open, like USSD, means that anyone anywhere in Zimbabwe with any cellphone is able to open an account.

The hope is that more banks will launch this sort of service soon. To be honest I don’t why more haven’t, because in my mind, with EcoCash heavily suppressed, banks should have leapt at the opportunity of offering access to as many people as possible.

Comments

4 responses

“After you have selected the account you want, you’ll need to select a branch and then you’ll get a reference number and confirmation saying the bank is processing your application. ”

Sounds the same as visiting branch with the necessary documents to apply for an account. You will obviously have to visit branch and furnish them with your particulars and hopefully not things like proof of residence and so on.

That’s very good,so how can l open an account while in South Africa.

Did you get any reply @ Brighton Maeni?

Bank account