A number of Zimbabweans have revealed on social media that their Binance and/or Coinbase accounts were recently restricted. They were then asked to withdraw their funds to other wallets or risk losing them. After that their accounts were permanently deactivated. In all instances their offence seems to have been that they are Zimbabwe.

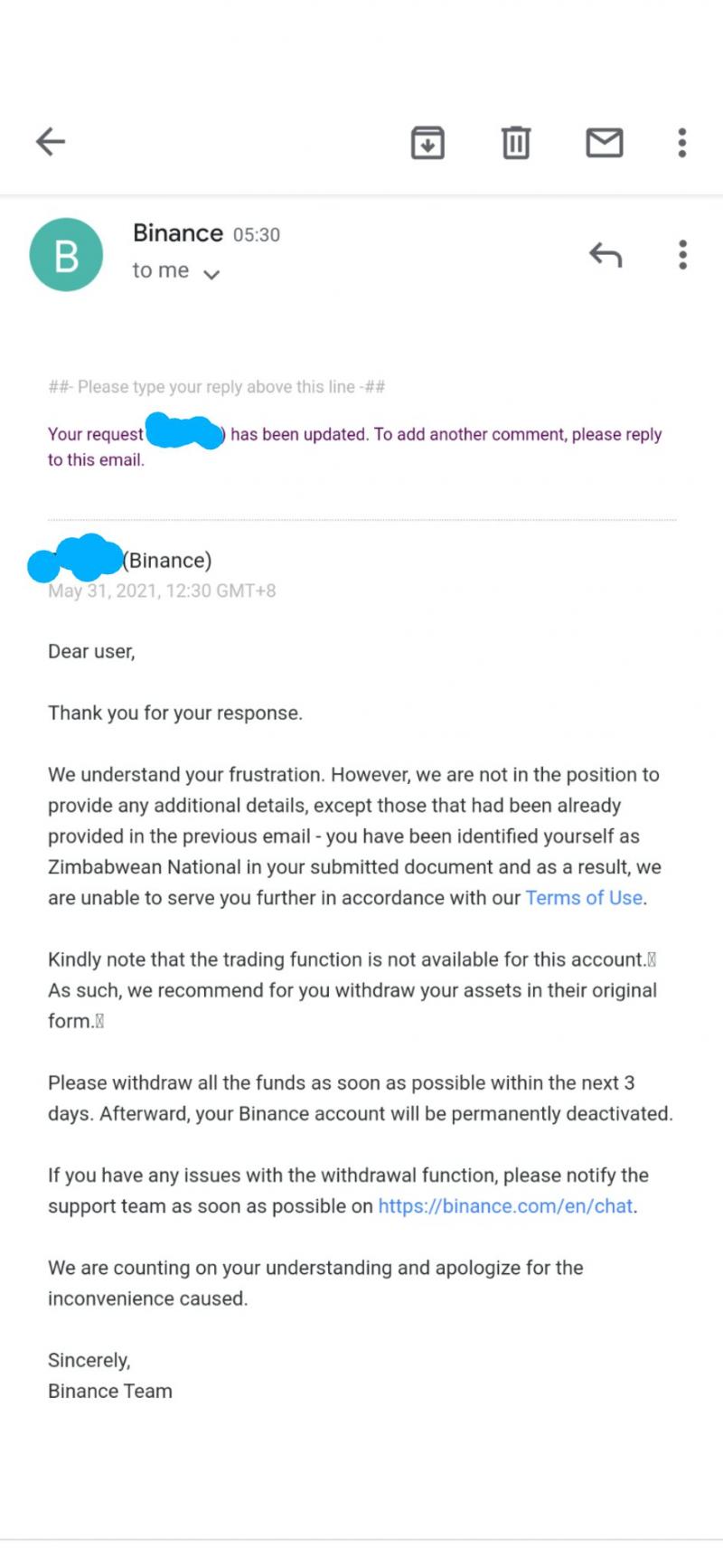

One user shared a screenshot of a message they received from Binance:

Second class citizens of the finance world

Being Zimbabwean generally means being a second class citizen when it comes to the international finance world. Very few platforms will onboard you if you mention you are from Zimbabwe. The bulk of them will shut the door firmly in your face and tell you no Zimbabweans are allowed. Skrill the only platform that seemed happy to see us has now joined the rest of them.

While cryptocurrencies are driven by the ideology that everyone is welcome and do not make use of government-controlled platforms to move funds they still have a weak link. For you to have cryptocurrency to spend and trade with you need to exchange your real fiat money for cryptocurrency. That usually means joining some exchange in order for you to be able to do this and as far as crypto exchanges go Binance and Coinbase are up there.

Despite the democratic nature of crypto-currencies the fact that you need real money to get cryptocurrency is a weak link in the chain. Governments who loath cryptocurrencies just go after the exchanges that facilitate the conversion of real money to cryptocurrencies. They just control these exchanges and usually, that’s enough. Take for example what the RBZ did to Golix which was on its way to stardom. With one stroke of the pen, they neutered it and send it to ghostland.

No Zimbabweans allowed

For some reason Binance and now it seems Coinbase too do not welcome Zimbabweans onto their platform. Some have claimed that this is because these exchanges do not have agreements with the Reserve Bank of Zimbabwe but that is just stuff that comes out of the rear end of a bull. Binance and Coinbase welcome people so many countries it’s almost certain they do not have an understanding with each of these countries central banks.

When you look at the list of the precluded countries they all have one thing in common. They are countries that have individuals that appear on the famous US OFAC list also known as the sanctions list. The list also includes countries that have been branded by the United States as supporters of terrorism.

The United States holds sizeable sway when it comes to international payments. That comes from them being the de facto leaders of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and their US dollar being the preferred currency for international settlements. It’s the sort of leverage they bring to bear when sanctioning entire countries and individuals they don’t like.

When an individual is targeted with sanctions the US tasks financial institutions around the world with the duty of making sure that sanctioned individuals don’t make use of their services and goes around sanctions. It is the duty of each financial entity to make sure their clients don’t violate US sanctions. If a financial institution knowingly or unwittingly aids such an individual they risk being fined by the US Justice and Treasury departments.

The fines are pretty steep:

- In 2017 CBZ bank was hit with a US$385 million fine

- Standard Chartered has also been fined in the past

Let me put it to you this way. Even the EU is wary of US sanctions which is why Iran remain isolated even though the EU is willing to come to its aid over the nuclear deal. If the second biggest economy in the world doesn’t want to run afoul of sanctions what hope do little crypto exchanges have?

An exercise in laziness

The laziest and easiest way to comply with OFAC restrictions is a blanket ban. This way you don’t have to worry about policing your database to make sure sanctioned individuals are using your services. You don’t have to worry whether one of those funny-sounding names is actually the sanctioned individual or just someone else who has the same name and surname. As a funny aside, even the US’s own lists used at airports to screen terrorists are no perfect. Often the innocent get caught in the dragnet. Nelson Mandela the paragon of heroism himself was on the US sanctions list taking off the list took decades.

So blocking Zimbabwe and other countries with sanctioned individuals is the easiest solution. The reasoning preferred by some administrators of these sites is that sanctioned individuals tend to be Politically Exposed Persons with clout who can get alternative official IDs and circumvent bans.

It must be noted that when it comes to these blanket bans, third world countries tend to be on the receiving end. It’s not hard to understand why. The exchanges consider the potential money that is likely to be made in these countries and reason that the cost of policing their services is not worth the risk that they might be caught servicing a sanctioned individuals and have to pay a fine. So in that regard, Zimbabwe joins countries like Afghanistan and Sudan on the naughty list.

Stubborn Zimbabweans

It’s not clear how the individuals who are complaining on social media managed to get Binance Accounts in the first place. As already mentioned Binance and other exchanges make it clear from the beginning that if you are Zimbabwean you are not welcome. Some Zimbabweans try to go around these blocks by using South African addresses.

The thing is, these days VPNs aren’t as good as they used to when it comes to protecting your identity. A lot of Fintechs now make use of third party APIs that can identify an IP as belonging to a VPN. Most will limit what you can do if you use VPN.

Comments

15 responses

Awwww snap. My dogecoin😭

DEX exchanges are the probable solution

It’s just tough guys, for the past 2 weeks I tried and tried until I came to understand that surely Zimboz where not allowed on these platforms. As a Software developer, l tried all tricks, using linux to mask IPs, etc but didn’t work, my binance account just got marked as US account and they told me, all accounts that aren’t eligible marked this way. Tried to open skrill, they identified IP masking. Tried opening neteller, they refused once they discovered my Zim passport, tried other providers, they dont accept credit cards issued in Zimbabwe like Visa from BancAbc or Mastercard from FBC. We are being seriously excluded from latest fintech space and its emotional!!

At the end of the end we no option BT to look up

A colleague of mine celebrated the trolling of the US govt until the US govt labelled us their enemies. We are now seeing what that labelling means.

The struggle is real, and we continue to lag way behind

It’s good to comply with rules, if the Ts and Cs are clear that Zimbabweans are not allowed to open accounts on the trading platform, then,🤷don’t cry foul and say your accounts have been closed, simply because you tried to be clever and beat the system, It doesn’t work, you simply get caught. All those With closing accounts need infact to be grateful full that they have been given a notice to withdraw their funds otherwise those accounts could have even been shut without notice. The other thing is that crypto markets unlike the stock exchange for example are not regulated, so if anything happens and you lose your money there is no where you can appeal for recourse, those are part of the risks people need to know before jumping in. Globally banks in some jurisdictions are flexing their muscles and making it difficult for people to buy cryptocurrency by coming up with regulations to block transactions to purchase these assets, even in the US itself Americans can’t buy certain crypto coins for one reason or the other, in some cases Americans living in select states are forbidden from trading in some platforms. Some platforms I’ve seen also do not allow residents of certain developed countries to participate. So Zimbabwe might have it’s issues but looking at it holistically the crypto market is shrouded in smoke. Right now in America they are cases, legal cases going on about these cryptocurrencies, There is still no clarity from the regulators there on what really constitutes a cryptocurrency and so forth, so yes Zimbabweans should not look at this as being so peculiar to them, it’s the very nature of the crypto markets it’s a very very high risk area not just in terms of market volatility but even in terms of the governing regulatory framework surounding it.

Risk versus Reward calculations are always being done so the charge of laziness is not really applicable.

The question that these companies ask themselves is

(1) can we write sort of a program that sifts out those Zimbabweans (and others) on the sanctions list

Answer = Yes

(2) Will this action generate a significant amount of revenue for our company ?

Answer = well most Zimbabweans for instance love this thing called a mbudzi fone they mainly use it for WhatsApp/facebook so the country as a whole will not generate significant revenue for us. So the answer is no.

(3) So when we get this wrong and we will, the result will be millions of dollars in fines for a country that might not generate 1 million dollars in revenue for us?

Answer = Yes

Alright just ban anyone from Zimbabwe or other sanctioned countries from accessing our platform.

And its hard to blame them the risk is too high whilst the reward is too low

In games they call this AREA OF EFFECT (AOE) the target gets hit but so does anything else around it…

The idea that sanctions can be targeted is a bald faced lie, or at best wishful thinking. Sanctions are not a bullet they are a grenade.

The US government really likes to slap sanctions on people they don’t like and they do it almost on a daily basis sometimes with no ryhme or reason…..

Nelson Mandela was in prison from 1962 so he wasn’t exactly in a position to be travelling or conducting any financial activities,when he was slapped with these sanctions 😏. The reason that he was still on that list up to July 2008 18 year’s after his imprisonment?

One of the reasons is Government bureaucracy the other reason is…. that thing…that thing we don’t like to talk about. You know what I’m talking right? if you don’t that’s OK let’s just leave it at government bureaucracy. 😞

Aaah iwe uchanyepera vanhu iwe

I rarely agree with Zanu PF, but haaa sanctions must go. Tabho!

Which app then is an alternative to trade these digital coins if you in zimbabwe

Try Paxful

We note with emotional concern the closing of Zimbabweans binance and coinbase accounts. It is indeed a great loss, that can be addressed. Victims kindly call 0715422190 or Whatsapp word Binance on 0784958161.

Together as Zimbabwe, we can make it….

Since we are Zimbabweans living in other countries why can’t they let us in and see how we will use it coz now individuals are dying for these political things pliz let us trade with these platforms