Zimbabwe’s is finally making the switch to e-passports after more than 20 years when the technology was first deployed in Malaysia in 1998. I and many others don’t have too much of an issue with the change from a security standpoint. Zimbabweans will be able to access Automated Border Control terminals and home and abroad. The smart travel documents will also afford us security measures far above what we have now but there is one big problem… Why was CBZ the only bank graced with the honour of accepting application fees for the new e-passports?

“A normal fee of $20 shall be charged for the application fee through CBZ bank countrywide,”

SI 273 of 2021

I have nothing against CBZ but from the perspective of convenience for the public surely this facility should have been extended to all banks in the land. We are all too familiar with how packed banks are these days, just last week civil servants queued en masse to get their bonuses.

Now imagine what it will be like when the rush for application fees for e-passports happens because for whatever reason Zimbos like to do things last minute (myself included). Add on to this the pandemic and we have a serious problem…

Zim banks are now just transaction fee machines

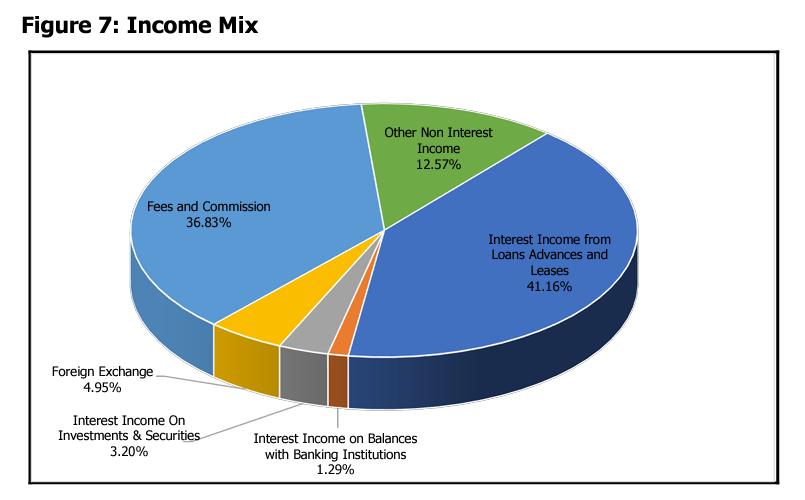

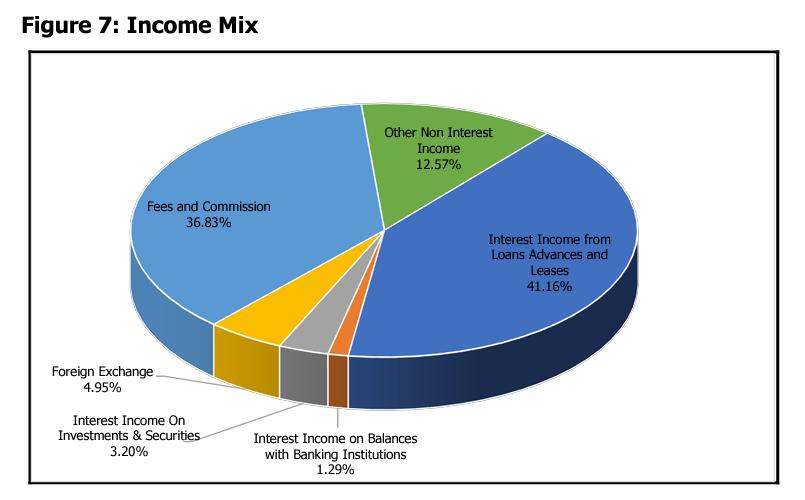

If there is something that we as Zimbabweans have had to contend with are the ever-increasing fees to store our money and transact. Now, this isn’t the fault of the banks because, traditionally, banks should generate the majority of their revenue from interest generating sources like mortgages, loans and the likes. In Zimbabwe, the economic situation is a little different because the banks are, in large part, credit shy because of defaulters, hence they must make their money at the point of transaction and service charges.

This peculiar phenomenon was noted by the Reserve Bank of Zimbabwe’s Banking Sector Report for the Quarter Ending September 2021

“During the period under review, interest income from loans and advances contributed 41.16% of the total income , an improvement from 16.29% of total income in reported in 2020. This indicates that the sector is shifting towards the traditional sources of revenue such as income from activities, which are financial intermediation considered stable and less vulnerable to changes in economic conditions and exchange rate movements.”

RBZ

Whatever operation a bank is set to do has a fee from balance enquiry all the way to an insufficient funds error (prepaid USD). What I am getting at is that CBZ is most likely not doing this for free, especially considering that foreign currency is involved with the e-passport applications.

This brings about three points/questions:

- Was there a selection process for which individual bank would be suited to this?

- What criteria did CBZ alone meet that the others didn’t?

- Was the pandemic factored into this?

Lastly, the exclusionary nature of this decision viewed from a banking perspective is detrimental because it concentrates whatever proceeds gained just to one institution. How then are the other banks supposed to make money that they could otherwise use for reserves or improvements?

You should also read

- Everything you need to know about Zim’s new e-passport

- CBZ to start identifying & reporting account holders suspected of illegal forex deals

- How do Zimbabwe’s prepaid US$ card fees stack up against one another?

- CBZ finally revamps eyesore of mobile app, phasing out old one

- Here’s how much your bank charges for all ZWL$ account transactions & services

Comments

25 responses

Guys, please help me out here coz I still don’t get it. Why are they physically splitting the transaction? What practical purpose can this possibly have besides turning passport applications into a 2 day torture session? All the stuff I have read so far does not explain this.

That’s the million-dollar question. We could just pay at the Passport Office but for whatever reason, they have chosen this course of action.

Sum is fishy here. Why do we need that bank for again. And why does this “partnership” with a zpf affiliated bank coincide with election season. We were doing fine getting our passports from districts offices. I think some funds are going to be diverted to the zpf campaign in my opinion

From a business perspective would you rally with your competitor or would you rather swallow them up 🤪🤪🤪 It is the initial phase and it would make sense to run with a horse that you have a long standing relationship with in this case CBZ … I see nothing wrong with this even ecocash first choice was CBZ they have proved themselves time and again and they deserve the honor…

I am sorry boss but you have missed the point. The move to have payment made to CBZ doesn’t make any sense. Why is it necessary in the first place. What makes that US$20 different from the US$100 that will be paid at the government office. Why specifically CBZ nd not any other banks, or payment systems in the country. It would have made more sense if POSB and Netone were chosen after all these are wholly government owned so why CBZ a private entity with no government shareholding. CBZ will not process this application for free after all unlike if POSB and Netone were commanded to do it. All this does is to help the profitability of CBZ but with no real benefit to the nation and its people.

Is our e-passport cheaper compared to other countries? and why there is no option for an equivalent ZWL. The US$20 application fee excludes CBZ charges.

It’s around the same price as some countries but those are not the cheapest though.

Cape Verde €50

Mauritania $115.68

Morocco €47

Somalia $100/$150 (if application is done from inside/abroad respectively)

Sudan $100

Bangladesh $48-$160 (cost varies on validity and number of pages)

Cambodia $100

Hong Kong $48/$59 (32pages/48pages)

Indonesia $66/$41 (48 pages /24pages)

South Korea $55

Turkey $160

Austria €75.90

Belgium €71

UK £72.50

Australia AU$ 298

ichibuda here

Shallow thinking 🤪🤪🤪 Better have your coffers where you have the upper hand….why give your competitors a reason to smile, funds will be needed to setup the system better to know that you are just taking from one pool and if there is surplus where not spend it on your campaign to remain the undisputed champion of the electoral system in Zim 🤭🤭🤭 last time mupfana Chamisa thought he could win will A4 posters 🤣🤣🤣 even music promoters do better than that…he should take a cue from these old lads when it is campaign time they know how to source their funds …

Who owns CBZ btw

Its all abt trying to control corruption and reduce cost of of invest for the register general. Ivo vanongozoita process for verification chete

Tagwirei owns CBZ, isnt that obvious?

Chingotengawo ma shares e CBZ pa ZSE wakanyarara. Some ordinary people are smiling all the way to the bank

There are things which take on a certain appearance, for example the horizon. This must be one of those. As for me, I think I will apply for one after the elections, by then a spade will be a spade.

CBZ is a listed company with tagwirei as it’s controlling shareholder. Chii chinokutadzisai kutengai ma shares eCBZ yacho pa ZSE then moita Mari mese na tagwirei wacho. You complain too much ma zimbo.

With this Covid-19 pandemic, is this not a risk to Zimbabweans queing only at one bank?

When did covid become a risk in Zim 🤔🤔🤔 Do you not spend all night binge drinking in packed bars without any thoughts of contracting covid kkkkk When the government makes a decision you start to peddle the risk factor grow up lads 🤪🤪🤪

Hatisi mbavha tese, hatisitese tinopemberera kudziya moto we kana ne mbavha.

CBZ was originally Bank of Credit & Commerce. In the early 80’s people used to say “bank of crooks & criminals”…ha ha ha

So the imperialist USD is loftier than the patriotic hondo yeropa money in liberated Zimbabwe?

Ndoiwana sei and kupi kwacho ndotoida

@Empress nuff said. @Bob nuff said. Anything less is just a load of crap

@Empress nuff said. @Bob nuff said. Anything less is just a load of crap

Have they already started issuing the epassport??

how soon will this be implemented