So… Reserve Bank of Zimbabwe (RBZ) Governor Dr Mangudya released the Monetary Policy Statement (MPS) yesterday ahead of the scheduled date that was mentioned in The Sunday Mail… Well, that’s all good with me because in the MPS we got more than a paragraph about the RBZ’s Fintech Regulatory Sandbox. In the MPS, the Central Bank Governor said that “the Sandbox had received 112 registrations on the online portal and a further 31 applications at various stages“

This is excellent news because it looks like when the number of applications that are still in processing reach completion, the number would have more than doubled from the 58 that were reported in 2021’s Mid-term Monetary Policy Statement.

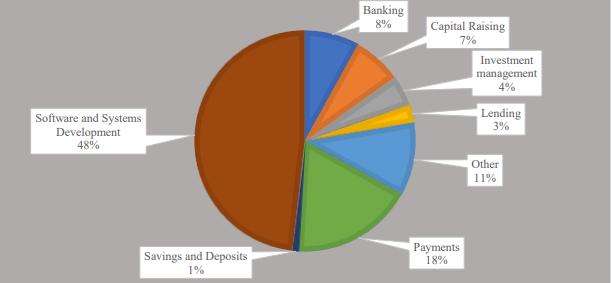

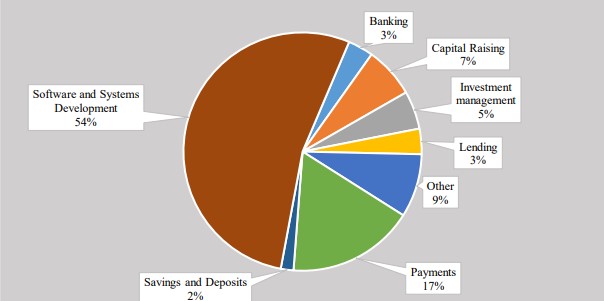

Of the 112 registered participants, software and systems development still reigned supreme with 48% even though it is is a 6 point drop from the 54% that were registered the previous year. Payment startups went up by a point from 17% to 18%.

Slide to the left for mid-2021

More registrations but nothing substantial…

All of these new registrations are encouraging but we still don’t have any more information than that. In an article we published this morning, the biggest issue was that we still don’t have a clue what the sandbox has been doing for nearly a year.

RBZ’s fintech sandbox needs to be more than a footnote in tomorrow’s MPS

The endeavour is supposed to bring fintech startups and traditional financial institutions closer together and maybe foster relations to improve financial services. But from what the Reserve Bank Governor has issued, we are all still none the wiser as to what the sandbox has achieved in almost a year of activity.

Now, I know that some of these things might be too early to discuss, but at the very least we could get some idea of which startups and innovations or even industries the regulators see potential in. This does two things, the first is that it’s an advert to potential investors and funders for these enterprises. There is no bigger endorsement for a sub-sector than a country’s central bank saying that it sees potential in it even if it’s the Reserve Bank of Zimbabwe.

The second thing is that it might encourage other startups who have not signed up for the fintech regulatory sandbox in that field(s) to approach the RBZ. The more the merrier for the central bank because it will have a larger constellation of businesses to work with and different perspectives…

Unfortunately, it looks like we will have to continue waiting for something more substantial from the RBZ about its sandbox, in the meantime, the gap continues to widen…

Comments

One response

https://chat.whatsapp.com/Immll2e9uKzE5uAGiXWAi2

Ccc group link ngaapinde hake mkomana