Reserve Bank of Zimbabwe (RBZ) Governor Dr John Mangudya is set to deliver the Monetary Policy Statement (MPS) tomorrow (8/02/22) according to a report by The Sunday Mail. Now, as usual, we will see what the central bank has been tracking as well as the effectiveness (or lack thereof) of its policies. Chief among those is the battle of the exchange rates, the Foreign Currency Auction, Inflation and other performance indicators. All those things are very important but there is something else that the RBZ needs to give us a comprehensive update on and that is the Fintech Regulatory Sandbox.

What is the Fintech Regulatory Sandbox?

The initiative was launched by the Reserve Bank of Zimbabwe as an interface between traditional financial institutions and startups innovating in the financial and payments space. From those interactions, banks would get a look at the innovations entrepreneurs were working on and possibly foster relationships that could improve services. The RBZ, on the other hand, gets a front-row seat that would allow it to forge policy more in line with where the world is going.

The RBZ Fintech Regulatory Sandbox is an important platform because it could propel startups to give companies like EcoCash more competition. Moreover, it will offer startups access to traditional financial establishments that are now more powerful than ever since the RBZ neutered mobile money. This could potentially see startups working with banks and other financial institutions on products and services.

The lack of information is concerning

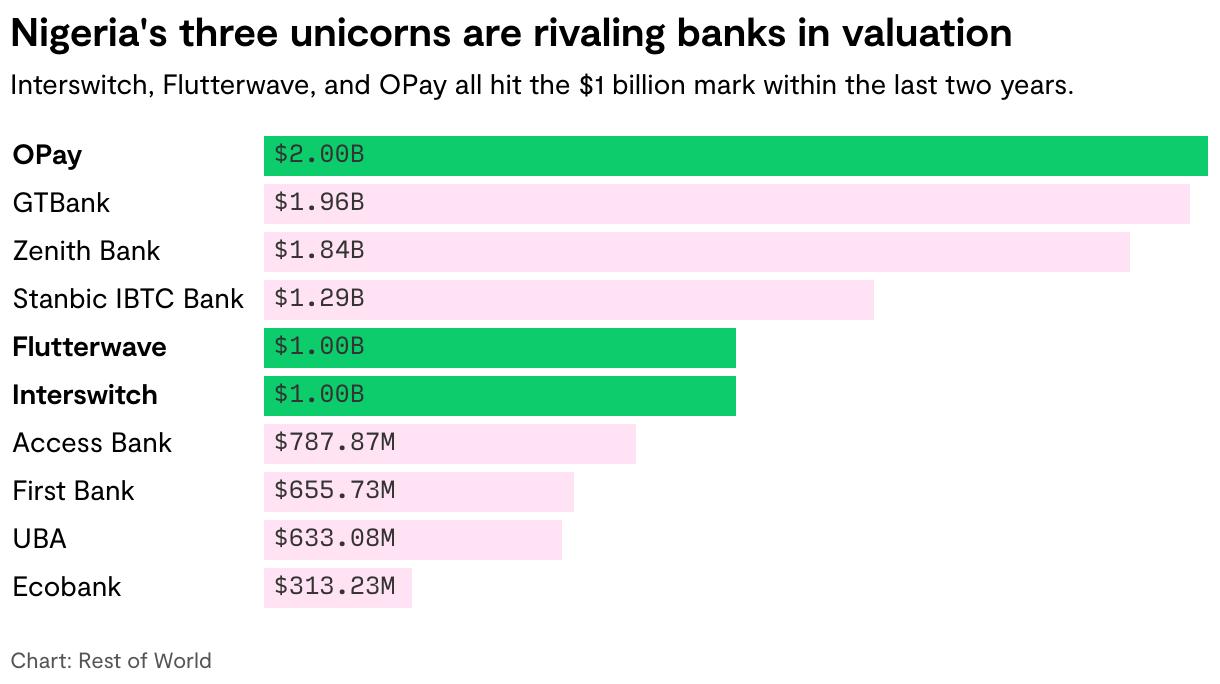

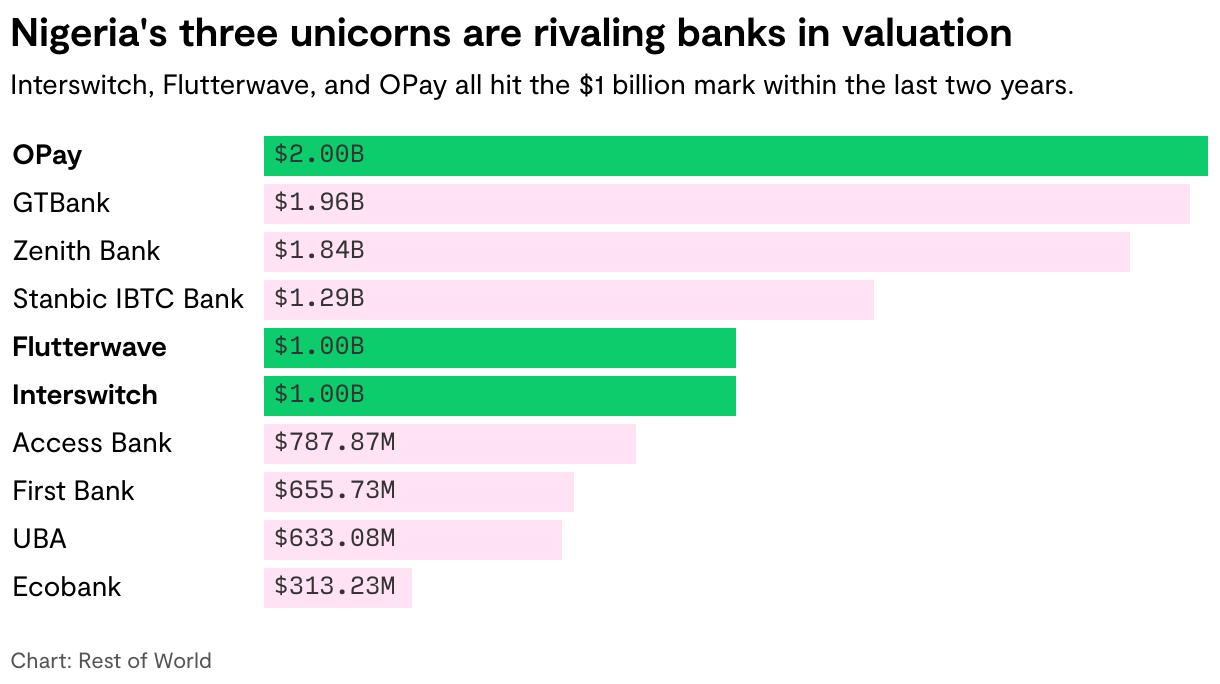

However, since the initiative was launched the only new piece of information (I came across) about it was in last year’s Mid-Term Monetary Policy Statement that said there were 58 Fintech startups that were on board with 14 applications being processed. Now, this being the only news about the Sandbox is particularly concerning because fintech is a billion-dollar industry in Africa. The country at the head of the pack is Nigeria which has seen native or locally founded startups like Flutterwave achieve unicorn status (valued at over a billion dollars USD).

Furthermore, Nigeria’s fintech unicorns are rivalling traditional financial institutions in terms of valuation

On top of that, Venture Capitalists are pouring money into African fintech enterprises. Last year, of the 5 billion or so that all African startups got in funding, fintech accounted for US$3 billion of that amount. This, at least to me, shows there is an appetite on the continent from both investors and consumers for fintech services.

Now, comparing Zimbabwe with Nigeria isn’t at all fair… The latter has just over 200 million people and that provides fintech startups with more potential customers who want financial services as well as the country having a better economy compared to Zimbabwe.

However, Zimbabweans have needs too… Who among you would not want to pay for goods and services online (even it is locally) with your local currency card. Wouldn’t you also want to have recurring payments for local services, thereby cutting the long USSD or bank app transaction steps to pay for the same service monthly? Or wouldn’t it be great if Zimbabweans entrepreneurs looking to enter the fintech space did not have to employ financial gymnastics in order to get their product to market?

These are the problems that the RBZ’s Fintech Regulatory Sandbox is supposed to help solve… But since it was launched there was little to no news about it. How is the taxpayer, who is bankrolling this initiative, supposed to know what opportunities could be on the horizon? Furthermore, how do we know how close or far we are to more progressive financial regulation and even the much-needed Startup Act?

Additionally, local fintech startups are missing out on the funding opportunities internationally that could help them scale their businesses

The RBZ needs to be more aggressive…

Looking from the outside in, it’s easy to assume that all the RBZ does is chase money changers. If we know more about what the RBZ has seen from the Sandbox this could help those who are launching their own startups and initiatives with valuable insights and might even push some established players to come knocking on the RBZ’s door to be part of it.

The relative silence surrounding the program doesn’t do anyone any good. Hopefully, Dr Mangudya will give us more than a paragraph on the Fintech Regulatory Sandbox in tomorrow’s Monetary Policy Statement. Moreover, we need to see a more aggressive approach by the central bank when it comes to the platform because the fintech gap is widening and we are falling further and further behind…