We have been going down the rabbit hole of the new “economic measures” and the most confusing one of them all was the suspension of lending or loans. I say this because Zimbabwe has not been a lending market because of the currency gymnastics that have been a feature of the last decade. One moment we had the USD and a while later it was banned, then it was back again and this is saying nothing about the war of the different exchange rates on the street and in official channels. Moreover, banks haven’t had the cash nor have the wider market had the collateral to back loans.

The first part is pretty much a regulatory and economic issue. We haven’t had a robust enough policy to deal with the informal nature of the Zimbabwean economy. The second part is more to do with defaulting loans. We have seen the value of money plummet this year alone with the black market leaping bounds away from the “official rate”.

All of these things have made banks very wary of lending, leaving the only demographics that can receive credit being civil servants who have the government as a guarantor and big businesses that inspire more confidence in the bankers.

And to be honest, it’s hard not to feel sympathy for the banks in the country because they aren’t really banks anymore…

How Banks make money

In a normal economy, (commercial) banks are considered lenders of money. They do this through the cash that you deposit and they run on a principle called Fractional Reserve Banking. Now, that might sound complicated but it essentially means that a bank keeps a portion of the money clients deposit for withdrawals and other immediate needs while keeping the rest to lend to people who qualify for loans and they earn interest from those loans

The interest on those loans is how banks should classically make most of their profits. However, banks can also make money through means like capital market income, other assets and the dreaded bank charges.

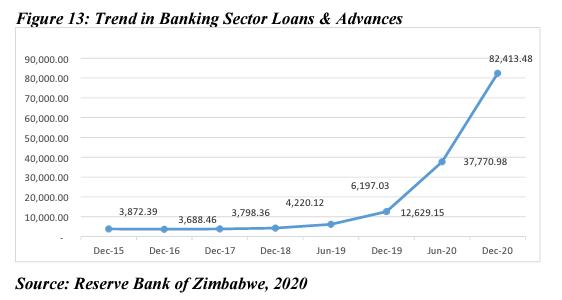

And we will get to those transaction fees in a bit, but before that, there was an encouraging trend of a two-fold increase in loans and advances as of the end of year 2020 from the local banks.

Total banking sector loans and advances increased 2.18 times from ZW$37.8 billion as at 30 June 2020 to ZW$82.4 billion as at 31 December 2020, largely attributed to the translation of foreign currency denominated loans.

Reserve Bank of Zimbabwe (RBZ) February 2021 Monetary Policy Statement

As noted by the central bank in December 2020, there was some appetite for lending by the banks due to the, near as makes no difference, dollarisation we were in. That being said, the RBZ did mention that there was still caution from the financial institutions when it came to lending however, the trend was nonetheless encouraging.

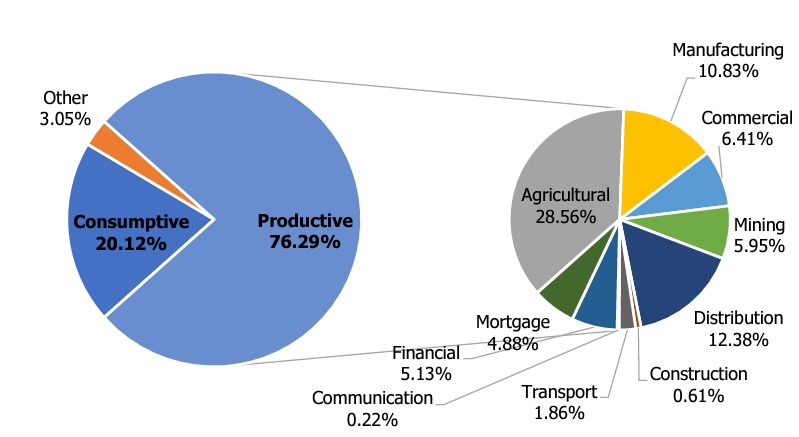

The distribution of loans was, according to the RBZ’s Banking 2021 December Banking Sector Report, in areas that were largely productive like mining, transport, manufacturing and others.

The Reserve Bank of Zimbabwe did, however, note the following

The Bank’s macroeconomic diagnosis suggests that consumption and investment expenditure are currently the main drivers of the country’s economic output but are being weighed down by lack of long-term lending. In fact, the analysis has shown that the country has been experiencing negative growth on real credit; a situation which dampens investment and the country’s growth potential.

Reserve Bank of Zimbabwe (RBZ) February 2021 Monetary Policy Statement

Why is all of this important?

The key point to take away from all of this is that love them or hate them, the banks are an integral part of how we all do business. If we have money to deposit, they have money to lend and we can spend on things like scaling businesses, buying homes, and creating employment.

This suspension of loans decree basically means that banks cannot fulfil one of their core functions. This results in the stagnation of businesses and leads banks to…

Increasing transaction charges to stay in business

If the banks cannot make money through loans (because they are now suspended), the only other easily accessible way to stay in business is to push the burden onto the consumer by way of transaction charges. This means that you and I should brace ourselves for an increase in bank charges because what other options do the banks have to keep the lights on.

To bring this into perspective, the revenue for banks was already seriously skewed towards Non-Interest Income which, according to the Reserve Bank of Zimbabwe, was at 79.5% at the end of 2020. At the end of 2021, that figure stood at 55.77% with Interest Income from loans & advances growing from 18.01% to 34.99%. This, to my eyes, means that the banks were gearing to get back to (and I am using this term loosely) the “traditional model“.

Swipe to the left for 2020

“Non-interest income was driven by fees and commissions due to increased transactional volumes on digital platforms in the wake of Covid-19, as well as initiatives by banking institutions to promote the use of plastic money

“Translation gains on foreign currency denominated assets, as well as, revaluation gains from investment properties also contributed to the growth in non-interest income”

RBZ Banking Sector Report for December 2021

It should also be mentioned that fees and commissions also grew (from 26.87% to 31.80%). However, that increase is far less dramatic than the one for interest generating channels.

Up go the transaction charges

The recent proclamation on lending indicates, at least to me, that the banks are going to lean on those things that make them money in the immediacy like charges for as long as the suspension of loans directive stays in effect.

For you and me, it means it’s going to be a bigger pinch at the till when we swipe on top of the 2% tax and VAT.

All of this begs the question, why was the document called “Measures to restore Confidence, Preserve Value And Restore Macroeconomic Stability”? Because as far as anyone can see it is not doing anything of the sort.

Comments

One response

Well said here

However i still believe that if banks would not increase rgeir charges and the cebtral bank revise all levies downwards that might play the ploy on restoring confidence

I think the problem we still have is trusting the decisions of the central bank.

There really is need for the central bank to revise downwards things like

VAT

IMTT

Overnight Accommodation Feees

Withdrawal fees

& aat the same time Zimswitch must play its part by reducing levies and taxes on all its platforms

I believe that will control tge so-called creation of broad money at all levels