For such a poor country, Zimbabwe has an embarrassment of natural resources. We have almost every precious mineral you can think of in large quantities.

Even in the fictional world of Vibranium, Zimbabwe is blessed too. It was hogwash but Kadoma was on the map in the electrically charged rocks stakes.

Back in the real world, just when we thought it couldn’t get any crazier, we heard about vast amounts of untapped oil and natural gas somewhere in this small country of ours. Africa’s largest reserves at that.

The key word there is – untapped. For the other already surveyed minerals the keyword there is ‘under-tapped.’

We talked about the lithium deposits that are apparently under every house in the country. The once not-so-precious white gold is a key component in batteries. As a result, demand for it is growing as electric vehicles gain popularity.

Zimbabwe is just starting to mine this mineral but it’s still the wild west in that area.

We are strutting atop Africa’s largest and the world’s fifth-largest Lithium reserves. Good enough to supply 20% of the world’s demand apparently.

We are literally sitting on gold, white gold. However, unlike yellow gold, which has stayed valuable for millennia, we have to hit the iron while it’s still hot with Lithium.

Some precious minerals lose their preciousness

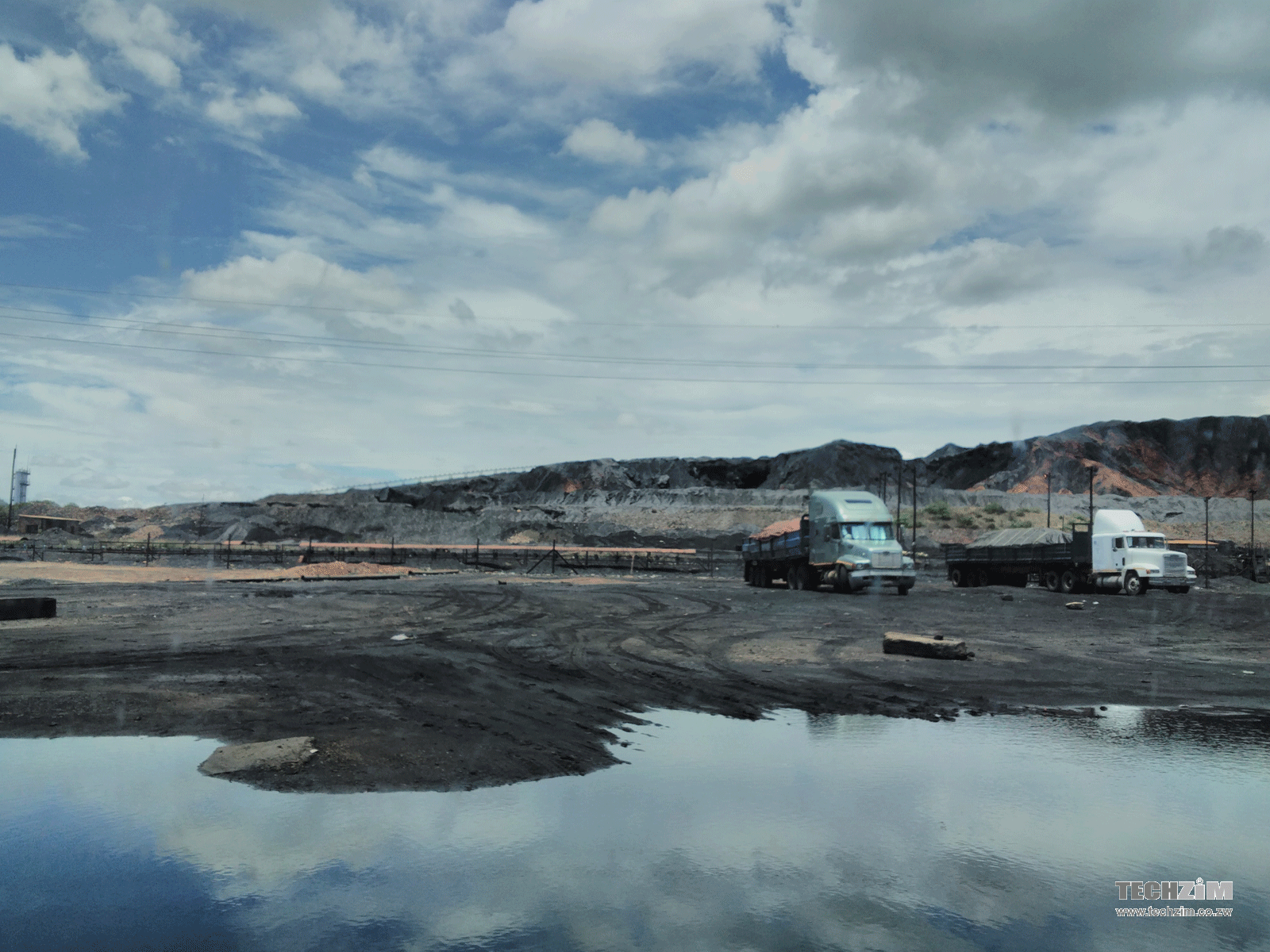

Coal had its time in the sun decades ago. However, as the world turned to greener sources of energy, coal lost some of its shine.

The Russia- Ukraine war has seen Russia close their natural gas tap which has led to some European countries giving coal a second look. That may be but coal is unlikely to ever reach its former highs.

The same goes for asbestos. It was once much more valuable than it is today. Then we found out some types of asbestos made people sick and the scientific community put in extra hours in the lab and came up with good synthetic alternatives.

This has happened to many minerals over the years. So, sitting on large reserves does not mean anything. We have to extract these minerals whilst the world still values them.

Lithium’s days are numbered too

Lithium still has years on battery makers’ grocery lists, with demand projected to grow by over 300% from 2022 levels by 2030, but work is already underway to reduce demand.

Work on sodium-ion batteries continues. As do other types of batteries that do not use lithium. We have seen some graphene batteries hit the market lately.

While these may not be ready to unseat lithium, who knows what advances they will make in the coming years?

We have all been watching these lithium-ion battery alternatives for years but there’s work in other fields that could contain lithium demand too.

The X-Engine

LiquidPiston is working on the X-Engine and claims their rotary engines are the first disruption to engine technology in over a century.

These new engines are said to deliver up to 10x the power-to-weight ratio of legacy engines. They are also 30% more fuel efficient while they are at it. To top it off, the engines are smaller and quieter too.

As if that’s not enough, these rotary engines have only a few moving parts meaning there are fewer points where stuff could go wrong. Leading to better reliability and cheaper maintenance.

You can geek out on the specifics here.

Why are we talking about these engines? Well, experts foresee a lithium shortage in the future. One mostly caused by politics, as China exerts too much control on worldwide lithium production and lithium battery production.

With this in mind, efforts to reduce reliance on lithium as the world goes green are on overdrive.

What the X-Engine provides is a way for new gasoline cars to use way less fuel. However, it is in hybrid cars that the X-Engine is expected to shine the brightest.

With this more powerful yet smaller and lighter X-Engine, hybrid electric cars can use 80% smaller batteries.

That right there means approximately 80% less lithium demand in those particular hybrid electric cars.

The X-Engine is still under development and so it will be a few years before it hits the market. That is if it even gets to hit the market.

So, it is not given that it will impact lithium demand in the projected way. Nonetheless, I found it interesting. I wonder what you think about it.

Zimbabwe’s real problem

While what we discussed may prematurely lour Lithium’s shine, it may not matter much to the average Zimbabwean.

The question we have to answer is, even if Zimbabwe does extract its Lithium whilst it’s still in demand, will the public actually benefit from that?

If the past is anything to go by, the Lithium and oil won’t change much for you and me.

So, would it be a shame if our lithium deposits lose value unextracted? I don’t know how to answer that.

All I know is that whilst some stockpile lithium mining claims, not actually mining anything and some complain about the Chinese controlling too many lithium mines in the country, the clock is ticking on lithium’s time in the sun.

So, it does appear as if worrying about lithium-ion battery alternatives and X-Engine is a little premature when we cannot even get the lithium out of the ground. Worse still, we may not win on our fight to get some of the lithium processed in the country.

Do let us know what you think about all this in the comments section below.

Also read:

Sadly, claims that electrically charged rocks (vibranium) found in DRC and Kadoma are false

Econet subsidiary DPA partners with Huawei on battery technology

Comments

17 responses

That X engine/Rotary engine should be the one on the Mazda RX7 Coupe if lam not mistaken.Just go Facebook and check on the bad reviews about that engine.lts good if you buy the car from manufacturer but for us zimbos who use beforward that engine iBotso.

Saw a couple of RX8’s in harare BC (before covid), one red, one white. They are beautiful cars in the flesh. If you are going to own a rotary in Zim, it needs to be out of love for the car coz it will need some serious TLC if its to survive. If you meet all its needs from warm ups/cool downs to special fuel/oil cocktails to paying attention to the apex seals, it can be very reliable. It just takes effort (a lot of it).

This X-Engine is different from Mazda’s Dorito, so hopefully it addresses the issues that brought wankel engines down.

God has given more than enough for each and everyone to live a high standard of life. Unfortunately, the stewards only know of subsistence and keep for themselves and a small circle of family and friends.

Just let the Chinese do their thing. The government must pressure the companies to build many processing plants here. It shouldn’t be a problem considering Chinese speed. This whole thing of running away from lithium is US politics at play. They just want to control everything. Anyways, it’s good for us as scientific development will be rapid because of their competition. I can assure you lithium will be in demand for a long time to come. Zimbabwean government must not let anyone export raw lithium just because they belong to ZANU pf. We are losing a lot because of that

I think the government should just dedicate some money into startups.

For example, if it costs 300million to set up a lithium plant. Why not sacrifice 300million this year from a certain sector and build a plant, run it for a year or so and sell majority stake to someone to recover the money. That way investor come knowing its an already established business.

You guys couldn’t even write an article without errors yet demand so much from the government.

As citizens, it’s our right to demand such. As gov, it’s their duty to do such. Clerical or grammatical errors are irrelevant.

Bless your heart.

You were in the special class weren’t you? Your handwriting must be so pretty, the letters shaped just right

But every country still uses coal ..US and China are on top of burning coal😁😁😁

Class is in session!

Let’s keep things simple so that everyone can keep up!

There will be a little bit of maths but don’t get scared it’s simple maths!

– $70,296 per per ton(1000kg) on world markets today

– $166.50 per ton(1000kg) in the USA today.

So class please answer these 3 questions

(Question 1)

which the more valuable product?

(Question 2)

How much is the difference between the two prices? “ Yes Deep State you’re allowed to use a calculator or your fingers whatever makes you happy” 😏

The world governments in an effort to reduce emissions of greenhouse gases have agreed to drastically reduce the production and use of the major sources of greenhouse gases such as coal.

(Question 3)

Which product would bring the most return on investment of time, money and effort for Zimbabwe if exported? Bearing in mind that the next 3 years the price of coal is predicted to remain stagnant and the price of lithium is expected to increase by 50%

“The question’s were so simple right?

I think even Winner Win and Deep State should been able to answer at least one or two questions! Don’t laugh we’re all God’s children no matter how simple minded some of us are!”

So Zimbabwe has 553 million tons of proven coal reserves this the amount of coal we definitely know is in the ground right now. At current prices that would worth around…

– US$91.7 Billion. That’s quite a bit of money!

But it’s meaningless because we export less than a 100 000 tons yearly, South Africa exported 65.75 million tons. So whilst we were sitting around playing with our genitals letting our coal industry slide into a coma, others were taking full advantage of their natural resources nd digging up coal like there was no tomorrow. Well turns out they were right there’s no tomorrow as far as coal is concerned. Since in the future the demand for coal is expected to go down drastically.

Estimated Zimbabwean lithium reserves (These are estimations there may be more or even less) and at current prices that would be worth about….

– US$759 billion OMG! that’s a lot of money! An obscene amount of money!

That’s about slightly more than 8 times the value of the proven coal reserves in the whole country just in Bikita mine alone! Even if that’s the only place with lithium and we never find more the export taxes on unprocessed lithium alone would be in multiple of billions and if we actually somehow managed to get it processed even partially it would do great things for the economy of Zimbabwe as well.

This is not the the oil and gas find in Muzarabani which was recently touted in the national Papers and Television to the uneducated and gullible that may never be developed because it may not be profitable to do so when you’re competing with countries that literally float on oil and can flood the market with product,crashing prices at will to basically kill off the competition. In the oil and gas marathon the front runners and the tailenders have been already sorted out, the Muzarabani find is us at the starting line at the South Pole whilst the tailenders are in Cairo, yes we can run the race and we should but any hope of winning is just a dream.

But lithium is the best chance that Zimbabwe has of being a front runner! The race has just started and we can still see the dust from the countries running ahead. So this means that we should be able to set terms on things like.

How much lithium is mined whilst the the processing facilities are being built.(many of them will be needed worldwide there’s no reason why we can get one built here)

– What level of processing is the bare minimum.

– What advantages is government willing to give for exceeding processing minimums (tax breaks etc)

– The minimum safety nd pollution levels allowed (lithium mining can cause pollution problems)

– Limits on how much is mined (after all the price is projected to rise in the future so it might be worthwhile to save something to sell at higher price)

– Worker safety, minimum renumeration and

https://www.hellenicshippingnews.com/south-africas-coal-export-to-the-eu-up-582-7-during-2022/

https://www.dailymetalprice.com/metalpricecharts.php?c=li&u=kg&d=240

https://www.worldometers.info/coal/zimbabwe-coal/

https://qz.com/why-zimbabwe-has-banned-the-export-of-raw-lithium-1849918099

https://markets.businessinsider.com/commodities/coal-price

Well said Empress. BRAVO

Now, create an Anonymous/Alias email & Social media account. Paste this on every account of “our civic leaders”.

This is excellent food for thought. If they fail to act on some of your points, Truly we are damned.

Again I say,

BRAVO

Lithium is going to another of those gifts from the heavens that turn into a curse for Zimbabwe.

Leaving it in the ground untapped isn’t even an option anymore, lithium is the “New

Oil ! ” the“ key to a better tomorrow! ” “the Holy grail for clean energy! ” etc,etc and etm.

So what would happen if Zimbabwe was stupid enough to implement a total ban on the mining of lithium? Well the Chinese would immediately call in those one sided loans that our government happily signed or the west would find a reason to place sanctions on Zimbabwe proper sanctions not this half hearted nonsense we see right now or if we were really unlucky the children of Zimbabwe would learn to fear the sky as missile attacks from UAV (Drones) became a daily occurrence from Operation Zimbabwe Freedom.

The mining of lithium is like sex with R Kelly no matter how much you kick and scream it’s going to happen!

But the thing that makes me sad is that the stewards of the nation that we entrusted with our future instead of trying to get us the best possible deal before we all emulate Queen Victoria by lying back and thinking of England (Zimbabwe) are enthusiastically joining in the rape/looting!

Sort of related question. Toyota has been getting increasing flack for not declaring a clear date of death for their ICE vehicles. Some have argued, amongst other things, that Toyota killing their ICE lineups in one fell swoop would negatively impact markets they operate in that are at a developmental disadvantage when it comes to EV infrastructure, costs, political will and economic utility. We know they are talking about the likes of us here.

Is the pressure they are getting from investors, governments and environmentalists to go full BEV fair or should they stick to following consumer demand in the many individual markets they operate in (and of course save on upfront EV production and R&D cost and keep the bottom line high)?

Is it fair to Toyota? Maybe not. But right now we know that climate change is real and that measures have to be immediately taken to reduce the detrimental effects of resulting from carbon emissions. So when we are talking about nothing less than the future of humanity on planet Earth as a whole fairness is irrelevant.

And the needs of the many must always precedence over the needs of the few especially when the few are just concerned about reduced profits.

Measures like this have been taken before. When it was found that the ozone layer had a big hole in it because of the release CFC’s into the atmosphere thus endangering all life on planet Earth. The production of CFC’s was banned worldwide and now the hole in the Ozone layer is shrinking. Was the ban on CFC’s production “fair” to the producers?

I do like the way that Toyota neatly sidesteps the fact that if measures aren’t immediately taken to reduce carbon emissions climate change will severely affect the countries that are at a “developmental disadvantage” the most. 🤔…Its almost as Toyota doesn’t really don’t care about us 😏😂

Interesting. I guess its true that the needs of the many have always had priority, but the dynamic just feels different when the ‘Few’ are so many. No doubt, Toyota is just looking at all that good money they’ll have to leave on the table and saying ‘nah, we want that’, but that also aligns with poor countries looking at how much of their other goals and GDP’s they’d have to give up to catch up on this one issue and saying ‘nah, we good for now’. At least Toyota committed to achieving Carbon Neutrality, something they can do by pushing better engine tech and hybrids to the povo and EV’s to the khiwa’s.

Well, I’m officially in the second half of life now (which is why seeing CFCs and the Ozone layer mentioned is so weirdly nostalgic!), so it will be interesting to see how all this goes by full time, assuming I don’t get a random red card before that😅

Toyota bet heavily on hydrogen fuel cell technologies literally billions of $ and they were by far the clear frontrunner in hydrogen fuel cell technology, they even made and sold cars using hydrogen in Japan and Europe. Toyota went all in on hydrogen and never even considered making an BEV. But hydrogen cars never caught on. Now Toyota due to its zero investment in BEV’s is on the back foot and is steadily falling behind it’s competitors. What Toyota badly needs is time, So they’re kicking and screaming and doing their best to avoid setting a cutoff date for the production of ICE vehicles, in order to buy time for themselves to learn this BEV technology.

But is what Toyota claiming about EV’s in Africa really true?

POLITICAL WILL

– This is the biggest problem in Africa to be honest, If you solve this issue then the rest of Toyota’s arguments are totally and completely irrelevant.

If governments in Africa just stopped putting in place unnecessary red tape in the way of potential private investors the electricity supply situation on the continent could be a whole lot better. In Zimbabwe for instance only ZESA is allowed to produce and sell electricity directly to consumers, so even though ZESA is clearly failing dismally at the task the government is hellbent on not allowing private players into the field but this could be all changed by a signature on a Statutory Instrument or new Law. As long as red tape is minimal, the conditions are good enough and there is money to be made you can be very sure that someone will come and invest to build the power stations that are so badly needed. Or the EV charging network for that matter. Governments are the biggest and main roadblock.

EV INFRASTRUCTURE

– Tesla didn’t just produce the electric car they also boldly built out the charging system with no government investment. Their supercharger network is the largest in the USA where the company first started out. This bold move which assured customers that they could travel long distances and still be able to charge their EV’s while travelling was the main reason to Tesla’s success. And once EV’s became a thing various private investors also invested into building their own charging networks to sell their services to EV owners for profit. And I am sure if there’s a market private investment will follow assuming there’s no government interference.

COSTS

– Tesla bore all the costs of creating the supercharger network but as soon investors saw the business case and profits to be made a lot of private investment came to build their own charging network’s. And in Africa a car manufacturer could copy Tesla by building out its own charging network in a selected country so it can sell its cars or private investors will do it for them. The various governments just have to avoid interfering.

ECONOMIC UTILITY

– EV’s after a high initial investment are very cheap to run and maintain and with the advances made in technology the high initial cost will be lowered. And the African peoples love of a bargain will take care of the rest no need to worry about that!