It is that time again, we get to look at the third mobile network operator – Telecel. We know the operator has been struggling for years as evidenced by these headlines from last year;

- Telecel now down to 0.5% voice market share, likely making 41c/user/month

- Telecel loses 56.5% of its mobile internet traffic

However, there is a new ICT sector report out, we might find that they turned a corner. We hope that’s the case, we need them to compete.

Telecel gains subscribers

What’s this? There are positives to report. Good going Telecel. They only say the customer is king/queen because without customers, there is no business. It is good to see that Telecel managed to reverse the trend and stop customers leaving. In fact in Q1 2024, they managed to add new customers.

Telecel saw a 1.73% increase in active subscribers, going from 281,332 in Q4 2023 to 286,213 in Q1 2024.

This was coupled with Econet losing a miniscule 0.04% of subscribers and NetOne losing a concerning 5.52%. Which meant Telecel saw its share of active subscribers rise from 1.88% to 1.94%.

Let us be clear, Telecel languishing with 1.94% marketshare is a terrible thing. However, while the jump from 1.88 to 1.94% is hardly a champaigne-popping achievement, it’s a good sign. Telecel managed to convince 4881 new people to acquire and use Telecel lines.

Unfortunately, it’s not all good news. When we then get to those subscribers’ usage stats, Telecel is still struggling to get people to recharge and use their lines. However, data usage stats are encouraging.

Telecel subscribers’ usage stats

Voice traffic

Let’s start with voice traffic. As you know, you have to pay to be able to make a call and that represents money (revenue) coming in for the mobile network operators.

Total voice traffic (i.e. for Econet, NetOne and Telecel combined) declined by 1.27% in Q1. We know that services like WhatsApp allow subscribers to communicate more cheaply, leading to a decrease in traditional phone calls.

We expect that to happen even more into the future. So, voice traffic is a shrinking pie but it’s still an important one. So, are Telecel’s subscribers making calls? Not as much as they should, unfortunately.

Telecel market share of voice traffic declined to a ridiculously low 0.13% from a similarly bleak 0.6% in Q4 2023. That is a 78% decline in voice traffic market share. However you look at it, 0.13% market share is concerning.

Remember too that Telecel has 1.94% of the active subscribers, which was an improvement from the previous quarter. Meaning Telecel gained subscribers whilst the other 2 lost them and yet Telecel saw its share of voice traffic decline.

Data traffic

As people move away from traditional calls, they need data to be able to use over-the-top services like WhatsApp. Hence why we have seen an increase in data usage accompany a decrease in voice traffic.

The data traffic pie is growing and is set to keep growing and so if Telecel manages to get a bigger piece of this pie, then that could offset the massacre they are being handed in the voice traffic fight.

What do you know, that’s what we see.

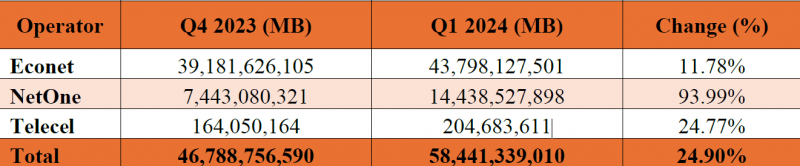

Telecel registered a 24.77% increase in mobile internet and data traffic. An impressive feat considering that Econet only registered an 11.78% increase.

It looks good if painted that way, however, that’s not the full picture. Telecel controls so little of the pie that even with that increase, their numbers are insignificant in the grand scheme of things.

The above shows that Telecel has 0.35% of the data traffic market share. All from 1.94% of the active subscribers.

This is better than the 0.13% market share they have in voice traffic and it’s also encouraging to see that usage increased significantly which led to Telecel maintaining 0.35% share from Q3 2023.

Implications for revenue

Unfortunately, the Potraz report does not tell us what Telecel’s share of revenues and costs is anymore. That’s the one gripe I have with the report.

That may be but we can make some speculations based on the data we do have.

We know that Telecel has 0.13% of voice and 0.35% of data market share. We don’t know what their share of SMS, VAS and other revenue streams is.

However, we know that voice and data make for almost all of MNOs’ revenue and that data revenue and voice revenue are almost equal. So, assuming Telecel has similar market share on those other revenue streams, which are not that significant, we can make some rough assumptions.

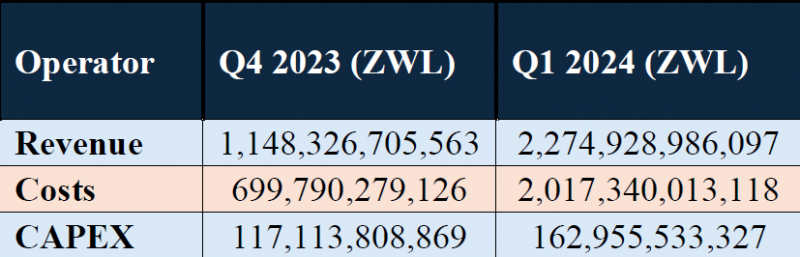

Total mobile network revenues were about ZW$2.27 trillion, which was approximately ZiG 910.46 million (or about US$67.5 million). Costs were approximately ZiG 807.37 million (US$59.9 million).

Let’s assume Telecel got a share of the revenue and costs proportional to their market share. That would mean

- Telecel made (67.5m*half*0.13%)+(67.5m*half*0.35%) = US$162,000.

- Operating costs were (59.9m*half*0.13%)+(59.9m*half*0.35%) = US$143,760.

- Which leaves profits of US$18,240

Remember that the costs mentioned above were just operating costs, which excluded all non-operating costs. In Econet’s annual report we found that operating costs were slightly less than non-operating costs. So, we can assume it’s worse for Telecel. However let’s just assume non-operating costs were equal to operating costs.

That would leave Telecel with a loss of $18,240-$143,760 = $125,520. It’s a rough calculation that’s likely better than the actual loss.

The only silver lining I see is that the whole sector is struggling and Econet made a huge loss in the year ended February 2024. So, Telecel has a valid excuse, it’s not just them.

What’s sad about that is that the actual situation is much worse. History tells us that Econet pulls in more revenue per user and that Telecel does not pull in revenue proportional to their market share. Telecel has had to run more promotions to entice users and so they make less per minute or MB used than does Econet or even NetOne.

Telecel lives on

At this point, Telcel is like that person who has been on life support for 5 years. You start to wonder why we are putting this thing through this pain when it doesn’t look like there is a light at the end of the tunnel.

That said, I would love to be wrong about this. I would love to see Telecel rise from the ashes but that won’t happen until shareholder squabbles are squashed and multimillions are poured into the company.

Comments

10 responses

I still hope it will rise from the ashes, with new players coming into the sector they can’t afford to lose the little customers they have

And someone says competition will miraculously cure the problem of the expensive mobile services in Zimbabwe

Telecel is the “murombo” trying to beat “chinenguwo”,time will tell.

Kkkkkk

Ko powertel and Africom we never hear of them anymore, are they still in the game, what internet services are they offering now ?

They’re still offering 3G cdma shit

they should sell to the New players

Telecel kwandogara network ahisisipo, ndoshaya kuti yakayendepi izvezvi network zero

The story about Telecel to me sound abit like that of Metropolitan Bank aka Met.Bank

Living on Life support for over 5yrs

Has anyone @Telecel heard of something called euthanasia? ( in ordinary terms – mercy killing).

That would be the kindest thing to do to Telecel.