Following on the introductory article, The Evolution of Money: From Barter to Blockchain, this article is an introduction to Blockchain and Cryptocurrency.

Overview of Blockchain Technology

Blockchain technology is a revolutionary system that has garnered significant attention over the past decade. At its core, blockchain is a decentralized digital ledger that records transactions across a network of computers. This decentralized nature, coupled with cryptographic technology, ensures that no single entity has control over the entire blockchain, enhancing security and transparency.

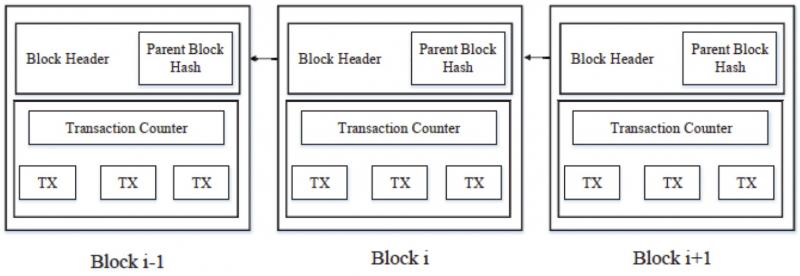

A blockchain consists of a series of blocks, each containing a list of transactions. These blocks are linked together in a chronological order, forming a chain, a blockchain. Each block contains a unique cryptographic hash of the previous block, a timestamp, and transaction data. The cryptographic hash ensures that the data within the block cannot be altered without altering all subsequent blocks, making the blockchain tamper resistant.

Blockchain abstract view showing a chain of blocks

Why Blockchain?

We are surrounded by centralized ledgers: to keep the records of title deeds / land registry, bank accounts, birth and death registry etc. Currently, we have little choice but to trust centralized record keepers that control these ledgers; thus, we are necessarily exposed to these three categories of risks:

1. Exclusion

For example a country or individuals can be excluded from normal banking channels due to sanctions but it is practically impossible to exclude someone from a blockchain financial network like Bitcoin.

2. Dishonesty

Possible corruption at the lowest and highest levels in any organization or group of people i.e. age cheating for sports which is rampant in Africa. In Zimbabwe there has also been a trend of people losing their homes due to fraud and corruption at the Deeds office, something which would not be possible with a blockchain distributed amongst Deeds office, Banks, City Council etc. For more information on the Deeds issue, checkout this Sunday Mail Article.

3. Loss of Records

Data in a central database can get accidentally get deleted or corrupted. Physical records can also get damaged from fire, moisture or handling. Blockchain effectively eliminates the risk of a single point of failure.

Introduction to Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. Bitcoin, created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto, was the first cryptocurrency and remains the most well-known and widely used.

Cryptocurrencies leverage blockchain technology to gain decentralization, transparency, and immutability (cannot be altered). Transactions are recorded on the blockchain and validated by network participants (nodes) through a consensus mechanism. This process ensures that the same cryptocurrency cannot be spent twice, solving the “double-spending” problem.

The advantages of cryptocurrencies include lower transaction costs, faster cross-border transfers, and increased financial inclusion. For individuals in regions with limited access to traditional banking services, cryptocurrencies offer an alternative means of conducting transactions and preserving wealth.

Basics of Digital Tokens

Digital tokens, are units of value issued on a blockchain. They can represent various assets or utilities and are categorized into different types based on their function and use cases. The primary types of digital tokens are:

- Utility Tokens: These tokens provide access to a product or service within a specific platform or ecosystem. For example, a utility token might grant access to a decentralized application (DApp) or enable purchase of items in an online game. Utility tokens are not designed as investments but as tools to access functionalities.

- Security Tokens: Security tokens represent ownership or stake in an asset, such as equity, bonds, gold coins, or real estate. They are subject to regulatory oversight because they derive value from an external, tradable asset. Security tokens offer potential benefits such as liquidity, fractional ownership, and easier transfer of assets. A property developer can for example issue security tokens allowing retail investors to own a fraction of an office park in return for a fraction of the rental income.

- Non-Fungible Tokens (NFTs): NFTs are unique tokens that represent ownership of a specific item or piece of content, such as digital art, music, or virtual real estate. Unlike cryptocurrencies or utility tokens, NFTs are not interchangeable on a one-to-one basis because each token has a distinct value and characteristics.

Digital tokens play a crucial role in the broader blockchain ecosystem by enabling various applications and use cases, from decentralized finance (DeFi) to digital identity verification and supply chain management.

Conclusion

Blockchain technology, cryptocurrencies, and digital tokens represent a paradigm shift in how we conduct transactions, store value, and manage assets. Their decentralized, transparent, and secure nature offers significant advantages over traditional systems, particularly in regions with limited access to financial services. As we delve deeper into their potential impact on Africa and Zimbabwe in subsequent articles, it becomes evident that these technologies hold promise for driving economic growth, enhancing financial inclusion, and fostering innovation. Stay tuned for the next instalment, where we explore the transformative potential of blockchain in Zimbabwe and Africa at large.

Simba Chinyani has a background in Actuarial and Financial Maths and is currently a Blockchain Academic, passionate about helping people navigate blockchain and the Decentralized economy.

Contact information:

email: csimba362@gmail.com

X (Twitter): @chinyani_simba

Comments

12 responses

Am interested in knowing how one can have a crypto wallet, fund it and transact if in Zimbabwe given the banking restrictions surrounding crypto

Good question. Also interested

Google for a crypto app , create an account, you fund your wallet by buying your crypto from an exchange online and you transact with other users if you have their addresses. Well, the whole point of being decentralised is being free of governments or banks so it doesn’t matter what they think or try to do about cryptocurrencies, people will always use them, for all is needed is a device, an Internet connection and the funds.

Also, research about btc addresses, keys to understand further and everything else before jumping into it…

That’s does not warn the person on the dangers of blind trust with respect to something security-sensitive like a wallet, when one is searching for such an app. The problem is how does one know who to trust when seeking a wallet. Later on, there is the risk that some wallets will be found to have flagrant security vulnerabilities. I can guess there are wallets made by some folks who got no business creating crypto wallets. What would be the best practices for the creation of a crypto wallet, and how does one even know if best practices where followed for some app.

Well, practice all those safety measures people are encouraged to (I’m not gona remind us because we’re all aware of them) especially when doing financial related stuff online.

Well, when it comes to wallet providers, only associate them when making transactions, don’t store any funds on them for longer periods, for they have a habit of disappearing with people’s funds e.g getting hacked, government shut down or whatever… Search the web for a way to store your crypto, like good old fashion BTC offline, like on some drive.

Mwana waMambo

There’s a number of ways from P2P (Peer to Peer) if you know someone who owns crypto to using a bank card.

If you have a card that does online purchases you should be able to buy it online.

You can keep it on a Centralized exchange like Kraken or Binance, or you can move it to a non-custodial wallet. The latter can be tricky for new users and if you lose your private keys, you can lose your assets.

Hi when you are new to cryptocurrency the best is to educate yourself about what you are getting into.Bitcoin is usually the most trusted for the most part (not a crypto guru or financial adviser) but from lay people experience that is the case. Try read up Bitcoin Beach documentary,Bitcoin Ekasi etc to get information on how lay people have managed to use it as a circular economy. Then on youtube you can subscribe on Adopting Bitcoin,Bitcoin for fairness,Bitcoin Dada Exonumia.cc(website) to get the education though there are even Shona articles. Wallets that have self custody include Muun,Luno,Binance,Machankura,Blink etc but some have KYC requirements and Machankura doesnt serve Zimbabwe on a USSD platform at the moment but does on whatsapp though all you can do there is send or receive as there are no merchants like SA has with Bitrefill or Ghana or Kenya for airtime. Blink also works but not too sure how you would buy at this point.

Things to note:

1.Volatility

As a beginner buying as little as R10/$0.50 can help you to see what happens to price.

2.Buying when price is low(dips).

Selling when price is high relying on P2P for payment but be weary of this option and ensure you work with people you know in person as once you have sent there is no way to recoup if you do so to a scammer which are many in this area.

*This part is where the areas where it is accomodated or self regulated like for Sa or on a Luno wallet one can withdraw directly to bank account etc.

3.Hodlers are those that just hold the bitcoin without buying or selling for long term purposes etc and usually have seen the return on investments the most as the downturns and upturns cancel each other out in the long run but us all dependent on the period you join

From a personal perspective I was alsoa skeptic so best way to enter when you are risk averse is to find gigs to do e.g translations or any way you can contribute to the industry with caution and get paid in BTC that way if anything dips you didnt put any of hard cash.

The other thing to note is that you can get graph over the years to fully understand growth over years.

The lived experience however differs for each person depends on the entry point as you can enter during a dip or upturn so even for transacting best to start small.

Binance

What a brilliant article, but let’s face it, Zimbabweans – we often join the party late when it comes to innovations and revolutions. And when we do, we’re often left vulnerable to fraud and scams because we don’t take the time to understand how this things work.

We’re tempted by get rich quick schemes and fast money, but that’s a recipe for disaster.

It’s time for us to take control of our financial education and future.I would like to take this opportunity to introduce you to Pi Network – a free, mobile-based platform that’s making cryptocurrency and blockchain accessible to everyone.

Joining Pi Network requires no money, just a willingness to learn. It’s a community-driven project that’s perfect for those who want to understand the basics of crypto and blockchain without risking a dime.

Let’s take our time to learn, research, and understand this new world. Let’s join the revolution informed and empowered.

You can use my username lewiszett when you join and for more information we already have a whatapp group with more than 120 members. Message me on tweeter or telegram @lewiszett for more information.

Join Pi Network today and start building your knowledge and future!

even me i like to learn more about crypto and blockchain, but the only blocked chain i know is when i pull the chain but my toilet is blocked, help please ..

Very informative article and hope that most developing countries can soon be able to participate in the digital money industry and it can create employment opportunities such that it doesnt feel like a far fetched idea for those that have not seen it work.

Buying bread or fuel using a Bitrefill voucher in stores or going to restaurants and grabbing coffee is a lived reality in some countries already so let’s see what happens.